SeamlessPay helps businesses reduce PCI compliance scope while improving payment performance. Our tokenization infrastructure, network tokens, 3D Secure authentication, and secure orchestration framework protect sensitive data without adding friction to the checkout experience. With one integration, you gain a common checkout page, security, flexibility, and higher approval rates across processors and geographies.

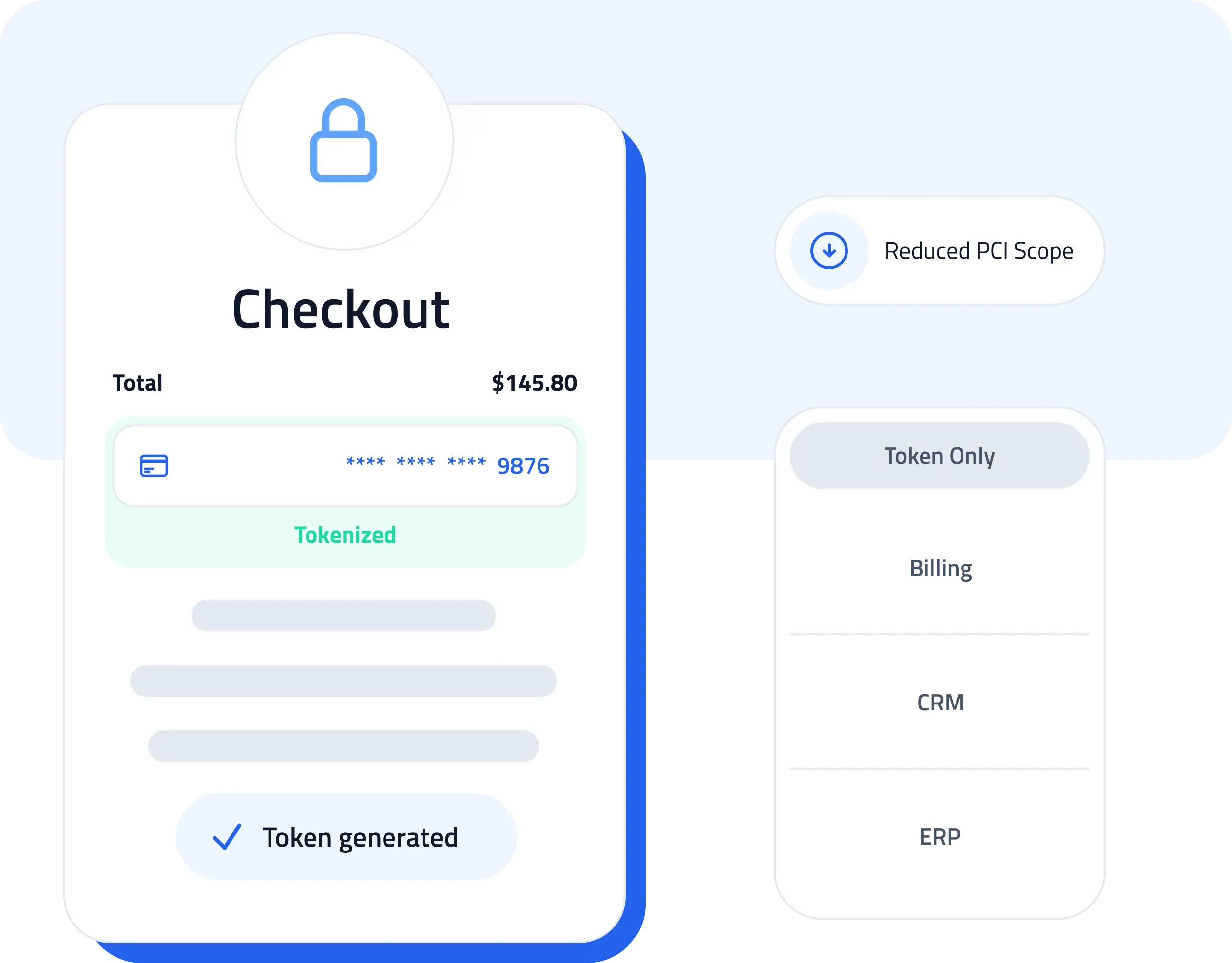

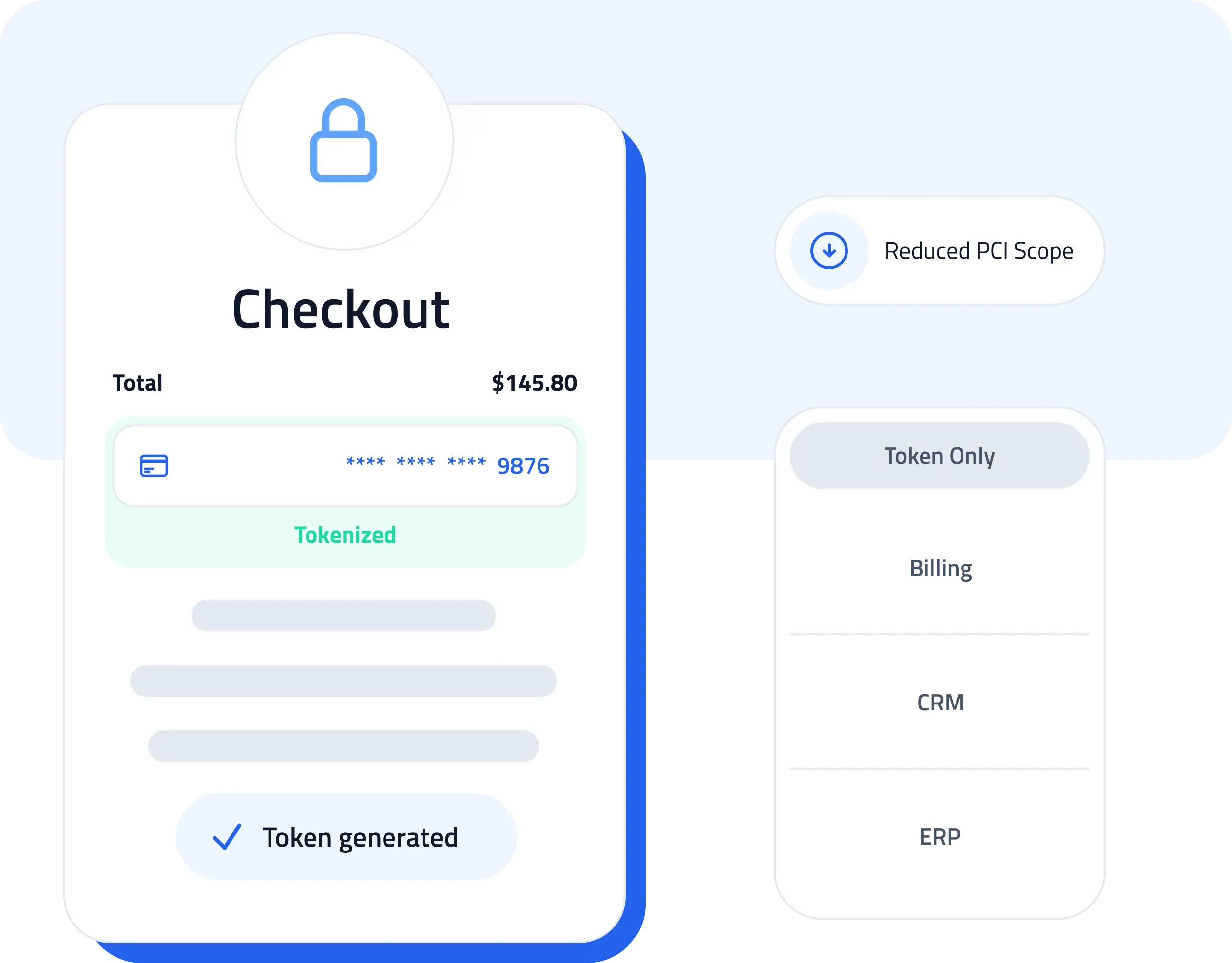

SeamlessPay replaces sensitive card data with secure tokens at the point of capture, dramatically reducing PCI DSS exposure. Our infrastructure isolates payment data while maintaining seamless integrations with your checkout, billing, and backend systems.

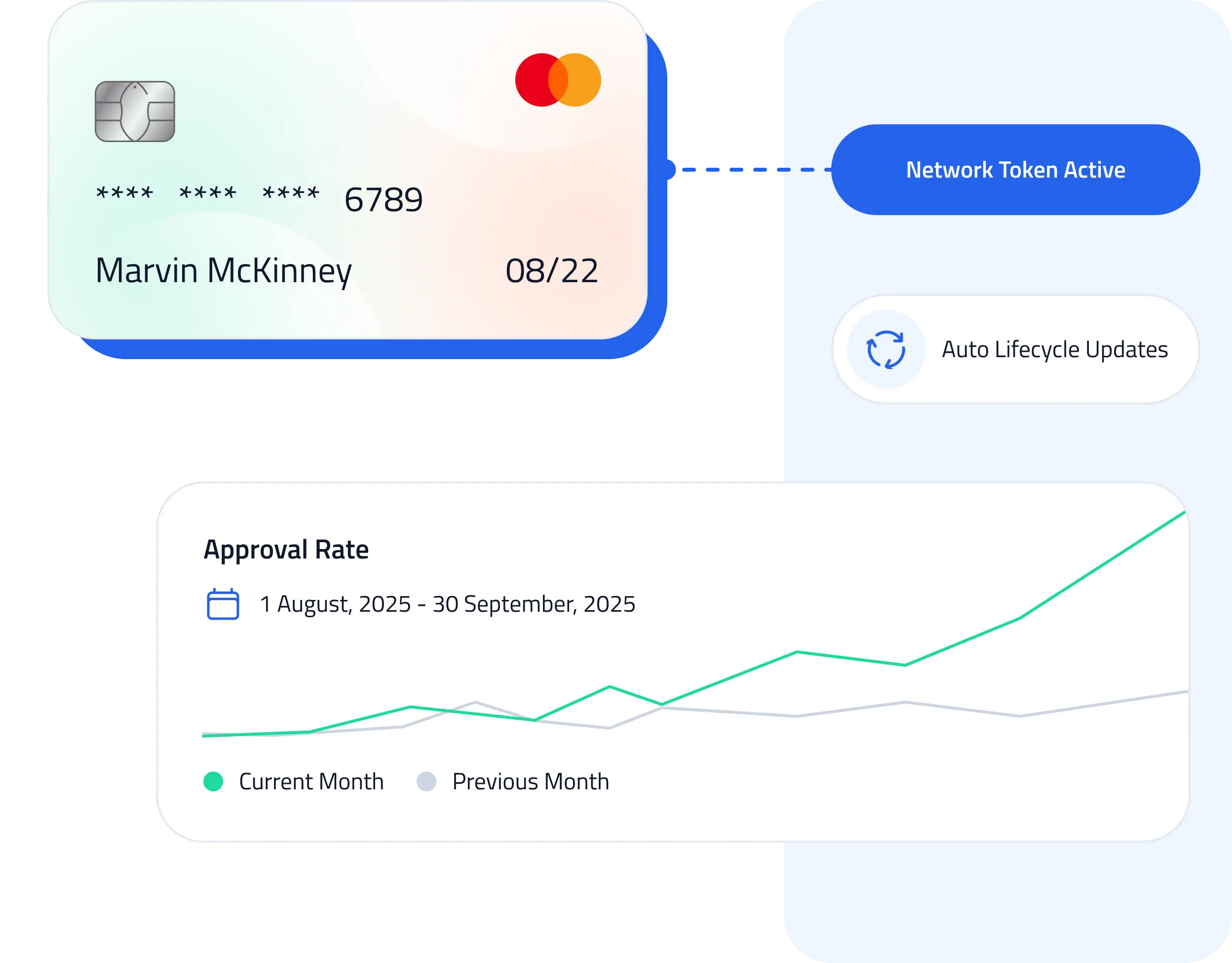

Network tokenization protects card data while improving authorization performance. Automatic lifecycle updates, better issuer trust signals, and reduced fraud exposure help increase approvals while strengthening compliance posture.

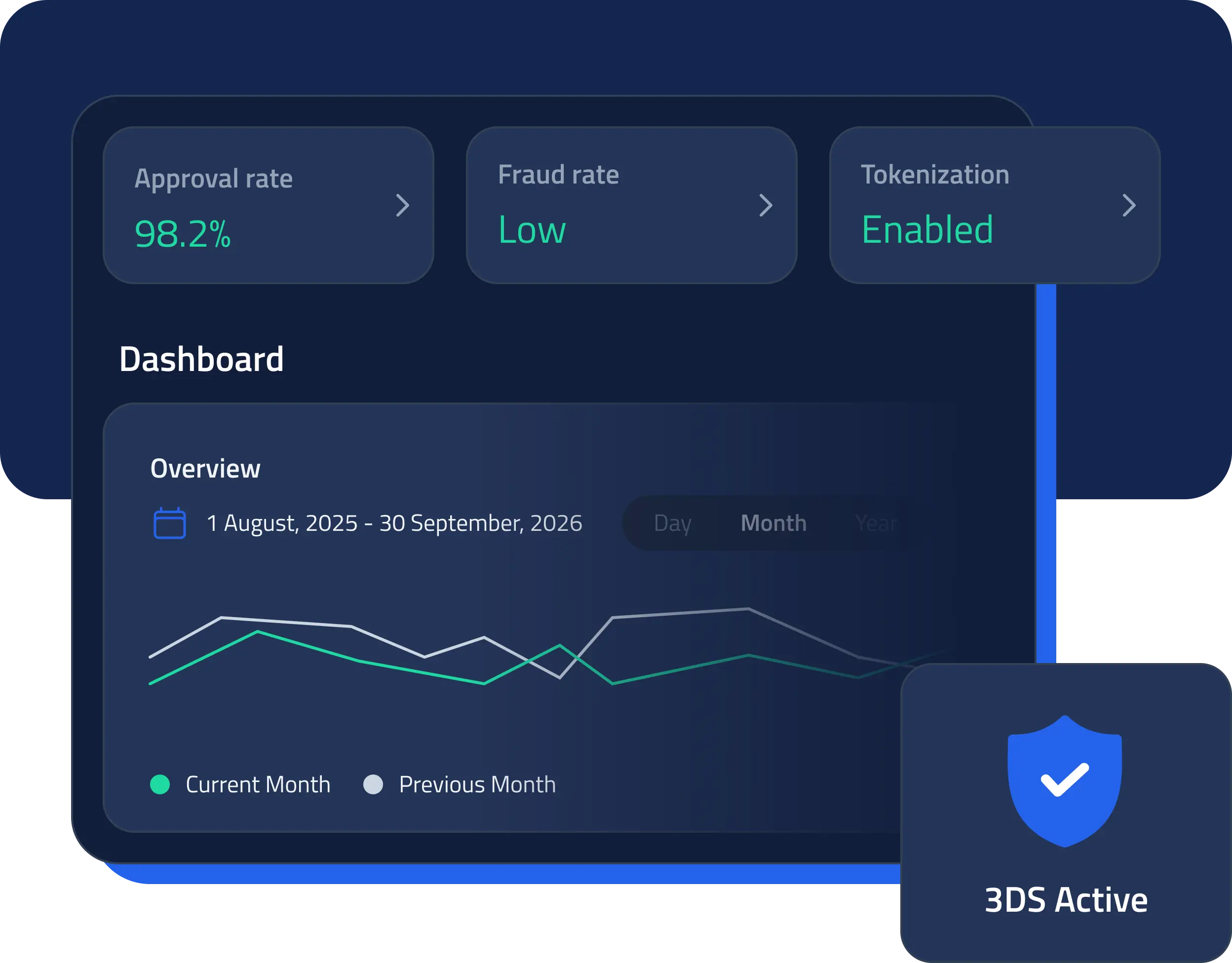

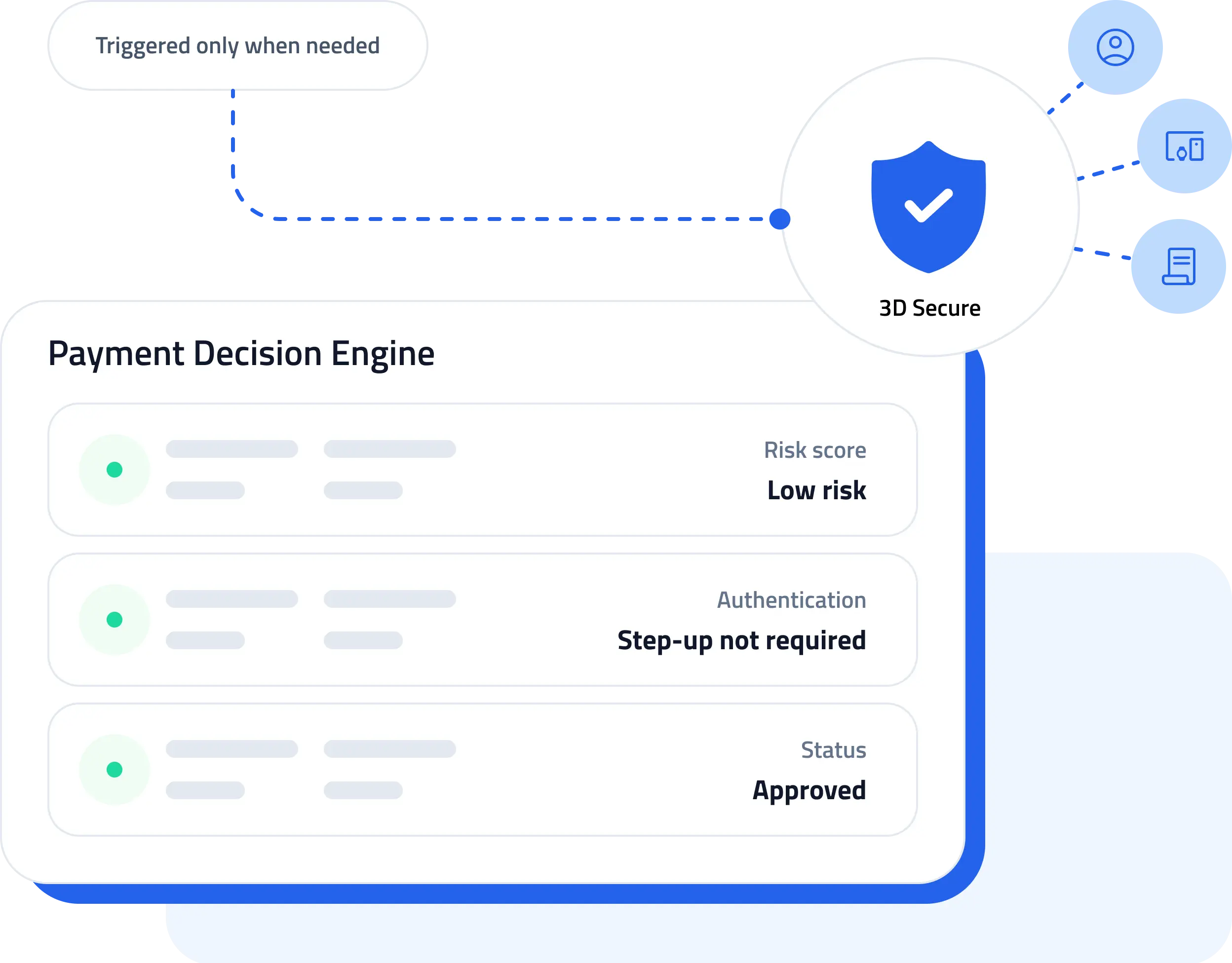

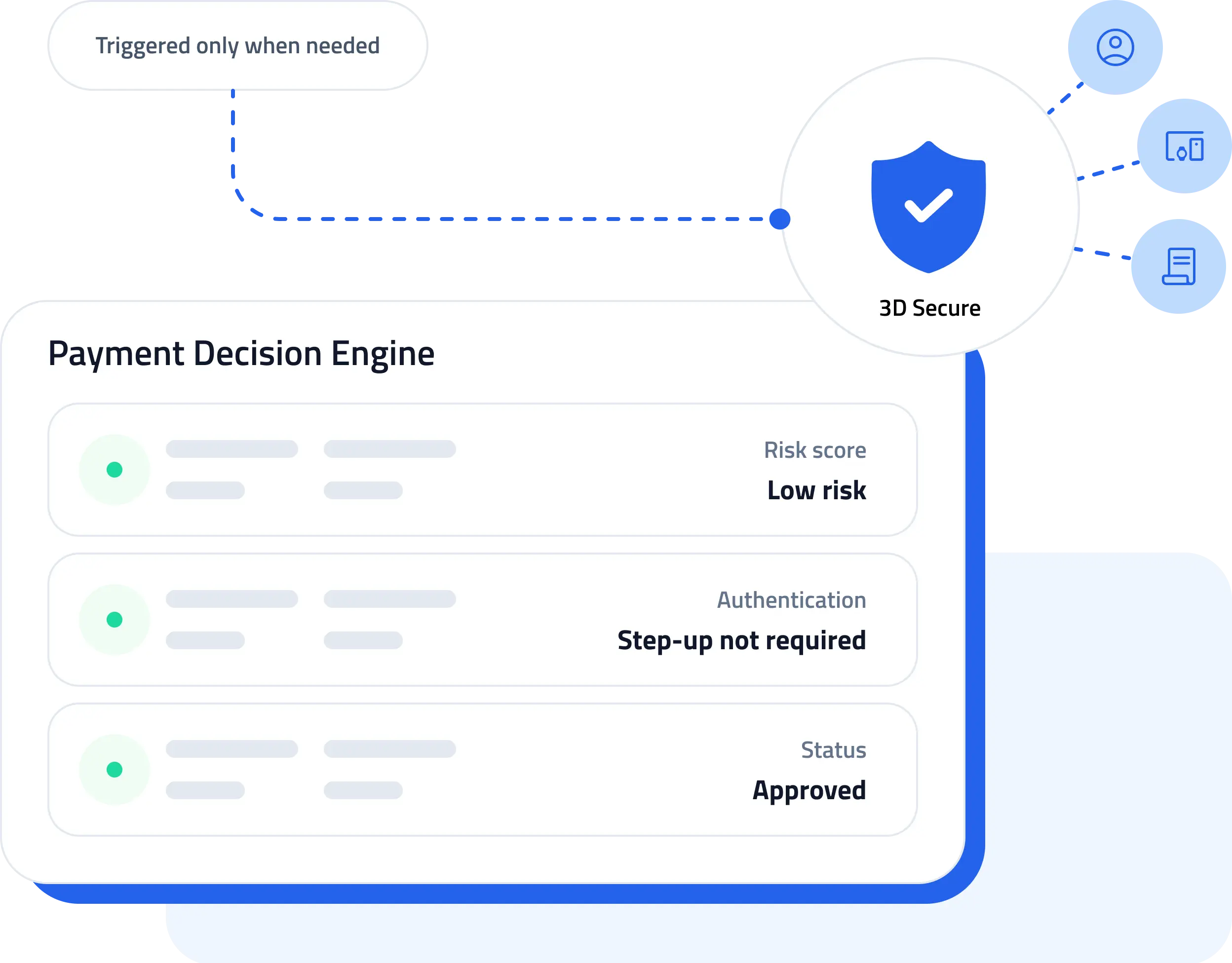

Integrated 3D Secure, real-time fraud scoring, and adaptive authentication allow you to meet compliance requirements while protecting revenue. Step up authentication only when necessary to maintain conversion rates.

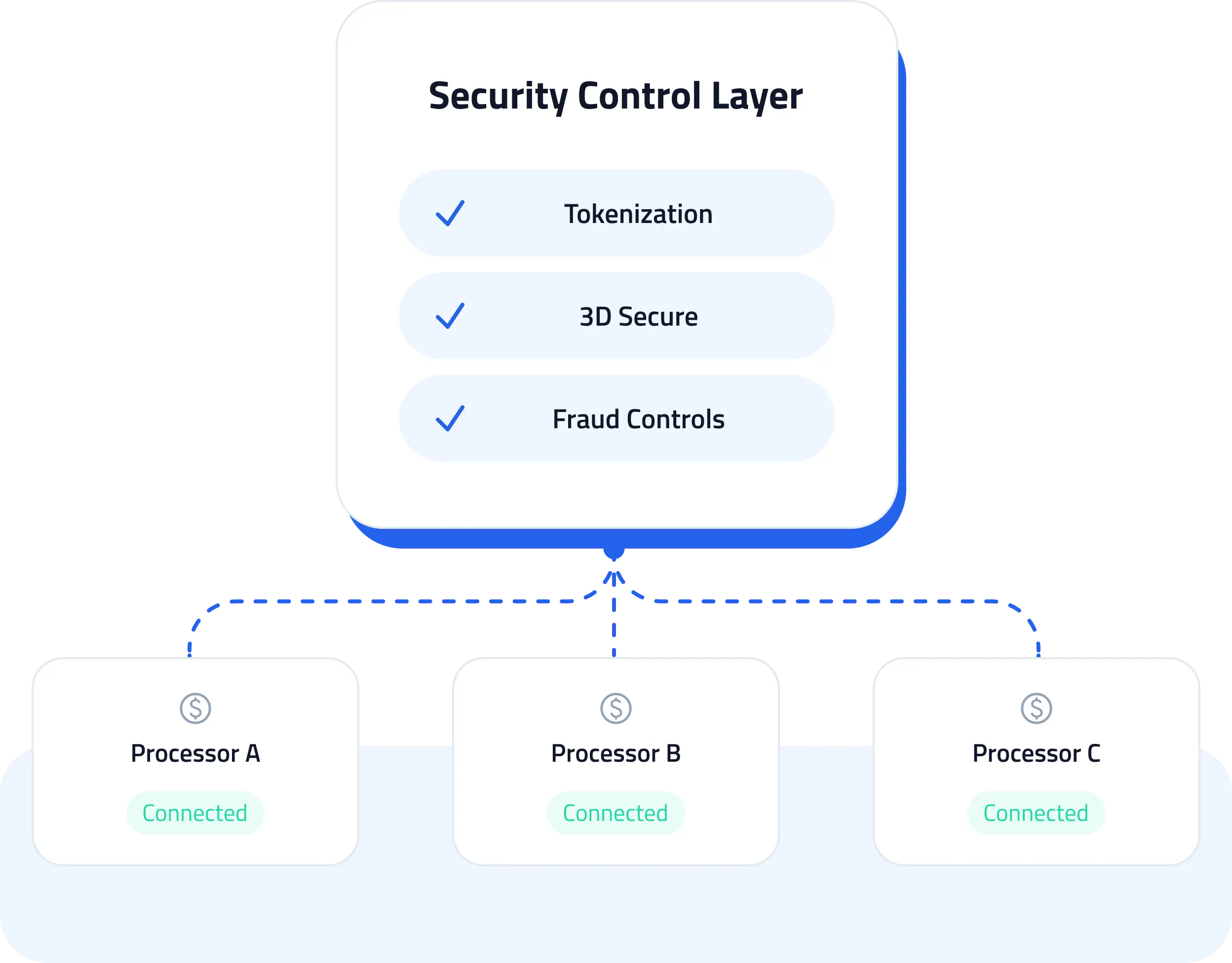

Avoid vendor lock-in while maintaining consistent compliance standards across multiple processors, gateways, and global markets. SeamlessPay centralizes security policies so you can scale confidently with one token and one checkout page across multiple processors.

Security that drives performance — not friction.

One token works across processors, channels, and payment methods, simplifying compliance while enabling routing optimization.

Smart authentication, fraud scoring, and issuer optimization protect transactions while maintaining checkout performance.

Real-time insights into approvals, fraud, and chargebacks help you continuously optimize security and revenue.