What Is Payment Tokenization?

Payment tokenization replaces sensitive card data (PAN) with a secure, non-sensitive token.

Instead of storing or transmitting real card numbers:

- You store a token

- The token points to the real card in a secure vault

- Your systems never touch raw card data

This:

- Reduces fraud exposure

- Shrinks PCI scope

- Limits breach impact

- And improves trust with issuers and networks

Why Tokenization Matters More Than Ever

Card networks and banks are becoming more strict about:

- Data security

- Fraud risk

- Transaction quality

- Dispute ratios

Merchants with poor data hygiene or weak signals:

- See more declines

- See more fraud

- End up in programs like VAMP or Visa monitoring programs

Tokenization, especially network tokenization, sends strong trust signals to issuers and improves performance.

The Different Types of Payment Tokens

1. Gateway / PSP Tokens

- Issued by a single processor or gateway

- Only usable inside that ecosystem

- Cause vendor lock-in

- Must be re-tokenized if you switch providers

2. Universal / Vault Tokens

- Issued by an independent token vault

- Portable across processors

- Good for payment orchestration and multi-processor setups

3. Network Tokens (The Most Powerful)

- Issued by Visa, Mastercard, Amex

- Bound directly to the card and device

- Automatically updated when cards change

- Trusted by issuers

- Improve approval rates and reduce fraud

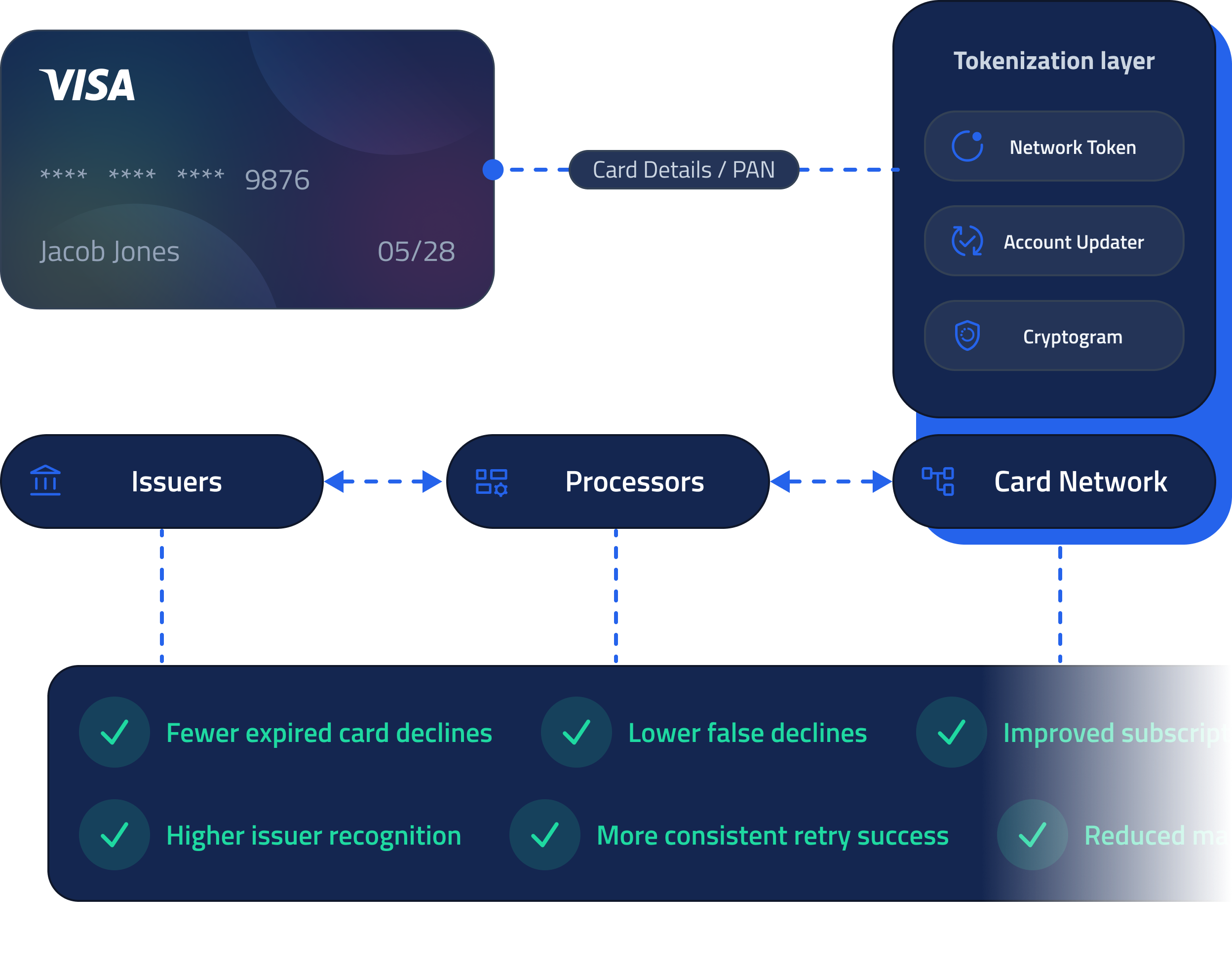

What Are Network Tokens?

Network tokens are card-network-issued tokens that replace the PAN with a token directly managed by Visa, Mastercard, or Amex.

They:

- Are more secure

- Are automatically updated when cards expire or are replaced

- Reduce false declines

- Improve authorization rates

- Lower fraud risk

They are one of the highest ROI optimizations you can make to your payments stack.

They are especially powerful for:

- Subscriptions

- Marketplaces

- Stored credentials

- High-risk businesses

Tokenization and Approval Rates

Issuers trust network tokens more than raw PANs.

That means:

- Fewer soft declines

- Better retry performance

- Higher approval rates

Combined with:

- Smart routing

- Account updater

- Better risk signals

Tokenization becomes a direct revenue lever.

Tokenization and Fraud Reduction

Tokenization reduces fraud by:

- Making stolen data useless

- Reducing the impact of breaches

- Lowering successful fraud rates

- Improving overall trust signals

Which directly supports:

- Chargeback prevention

- Healthier dispute ratios

- Staying out of VAMP

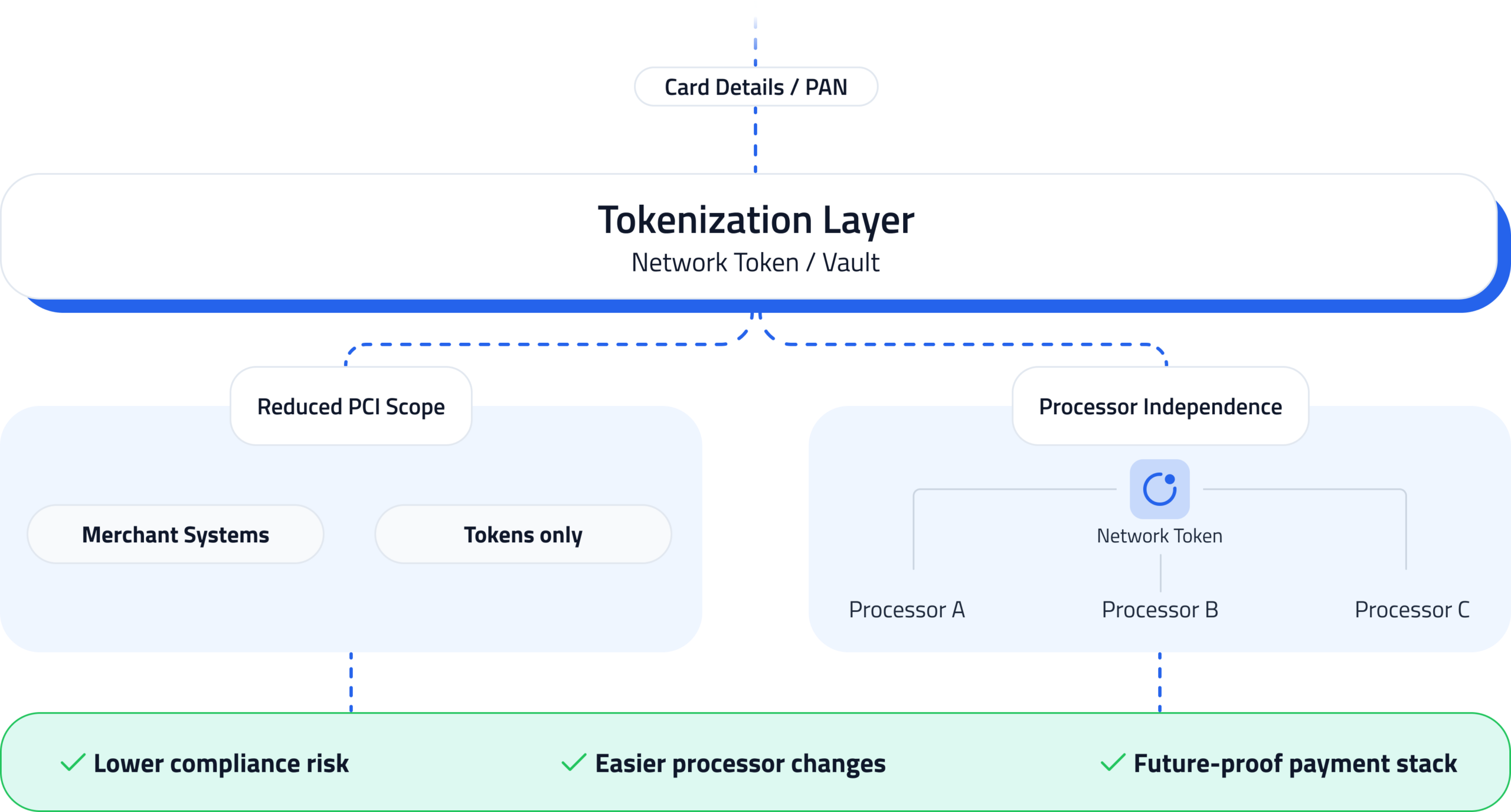

Tokenization and PCI Compliance

The PCI Benefits of Tokenization include:

- Removes card data from your systems

- Shrinks PCI scope dramatically

- Lowers compliance cost and risk

Instead of protecting PAN everywhere, you protect one vault.

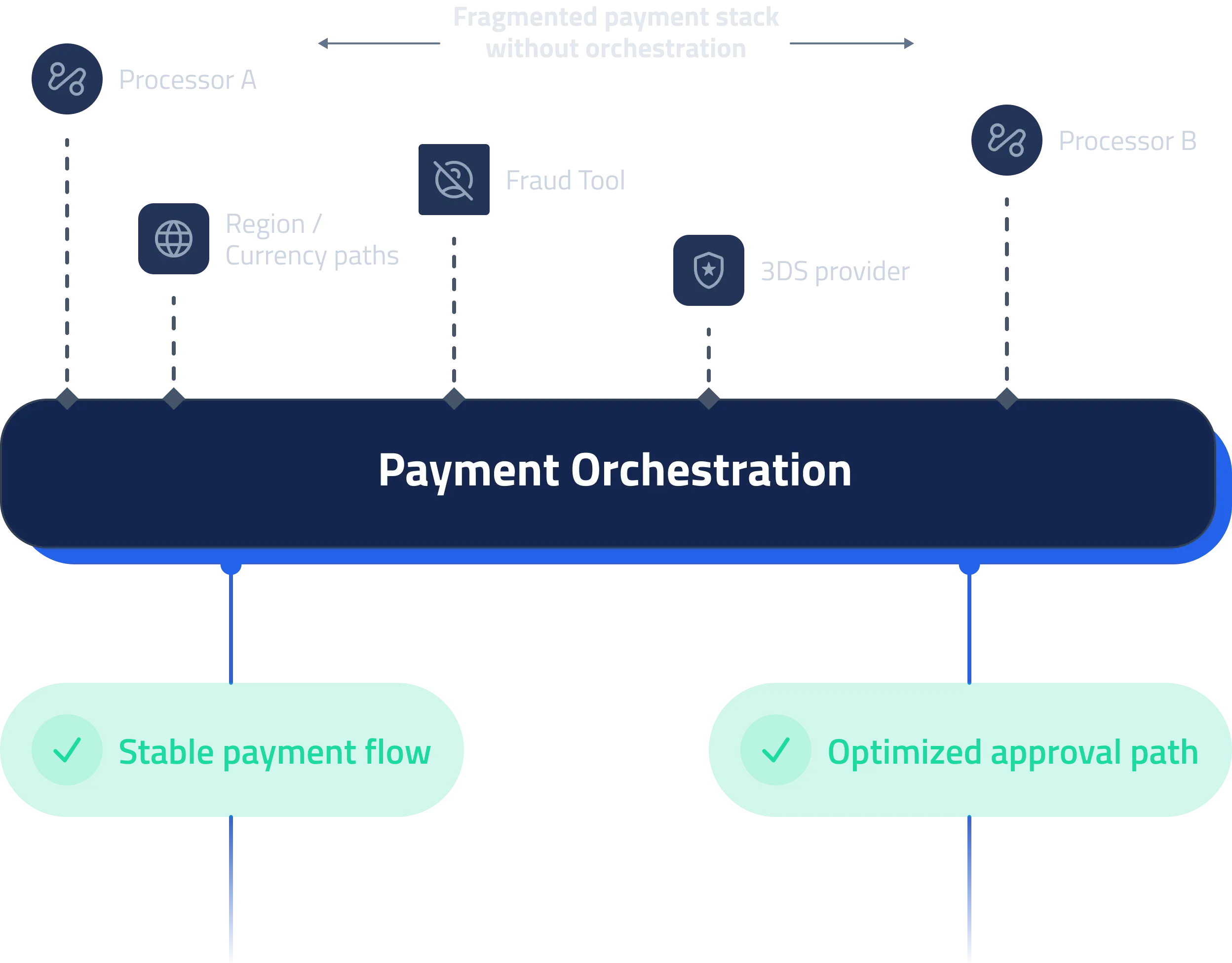

Tokenization in a Multi-Processor World

If you use:

- More than one processor

- Or want processor independence

You need:

- A portable token strategy

- A universal vault or network token strategy

Otherwise:

- You are locked in

- Migration becomes painful and risky

The Modern Tokenization Stack

A serious tokenization strategy should include:

- Network tokens

- Portable / universal tokens

- Automatic card updater

- Secure token vault

- PCI isolation

- Integration with routing & fraud systems

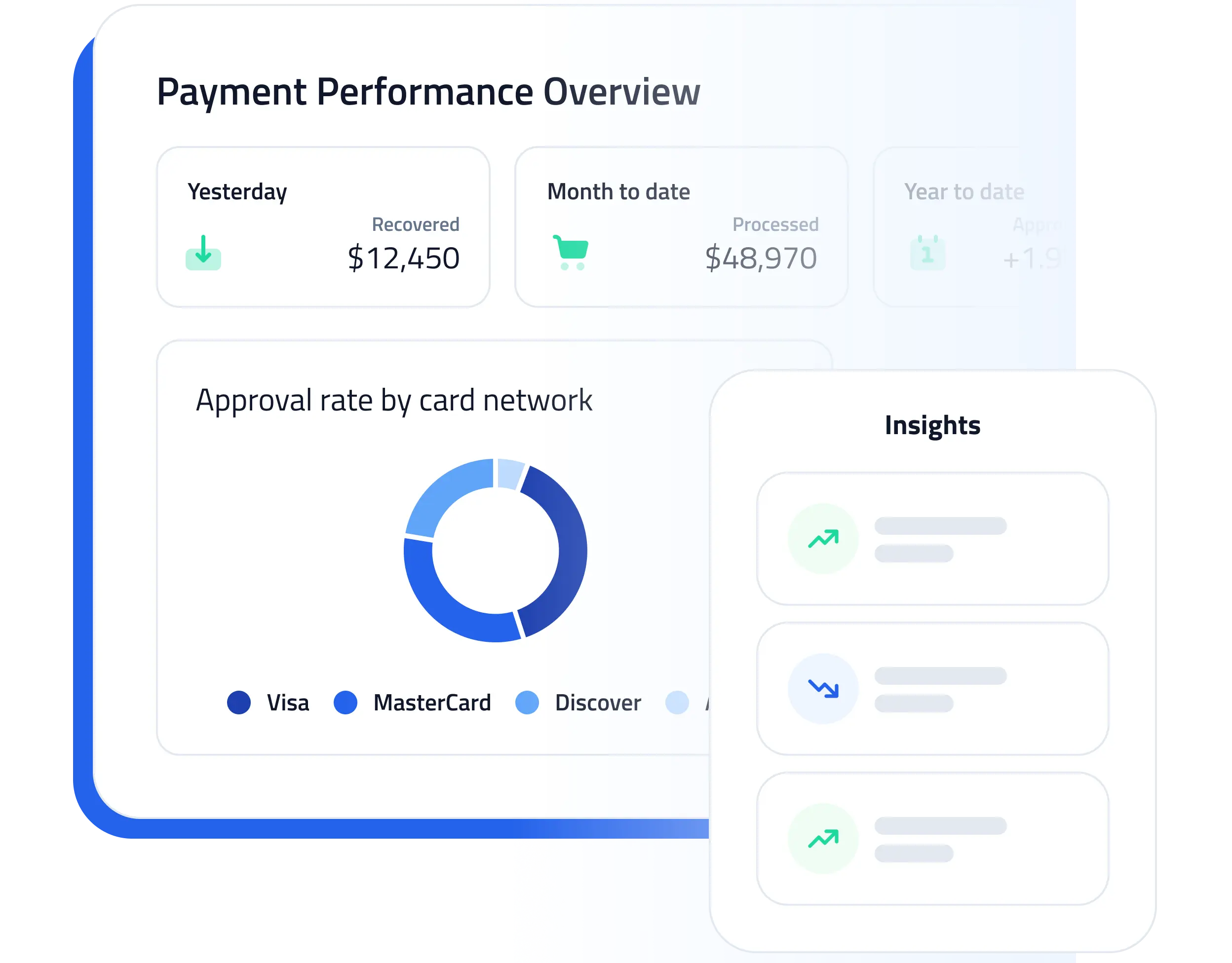

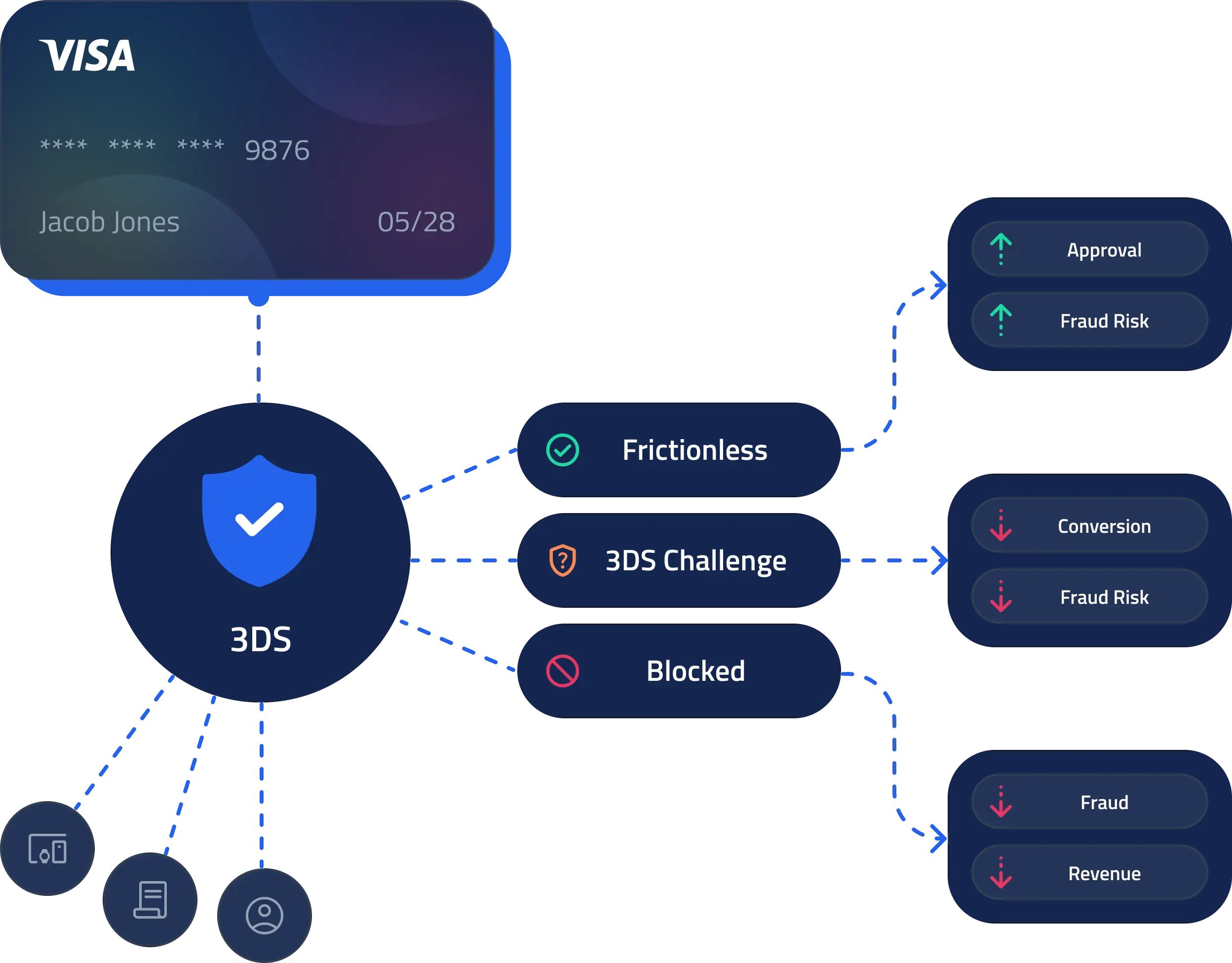

How SeamlessPay Uses Tokenization

SeamlessPay uses tokenization as part of its payment optimization and risk engine.

You get with SeamlessPay’s Tokenization platform:

- Network token support

- Universal token vault

- Built-in account updater

- Multi-processor portability

- Deep integration with:

- Smart routing

- 3D Secure

- High-risk payment stacks

- Chargeback prevention

How to Roll Out Tokenization Safely

Step 1 — Audit Your Current Tokens

Are you locked into one PSP?

Step 2 — Add Network Tokens First

This is usually the biggest win.

Step 3 — Add Account Updater

Prevents avoidable subscription declines.

Step 4 — Make Tokens Portable

Future-proof your stack.