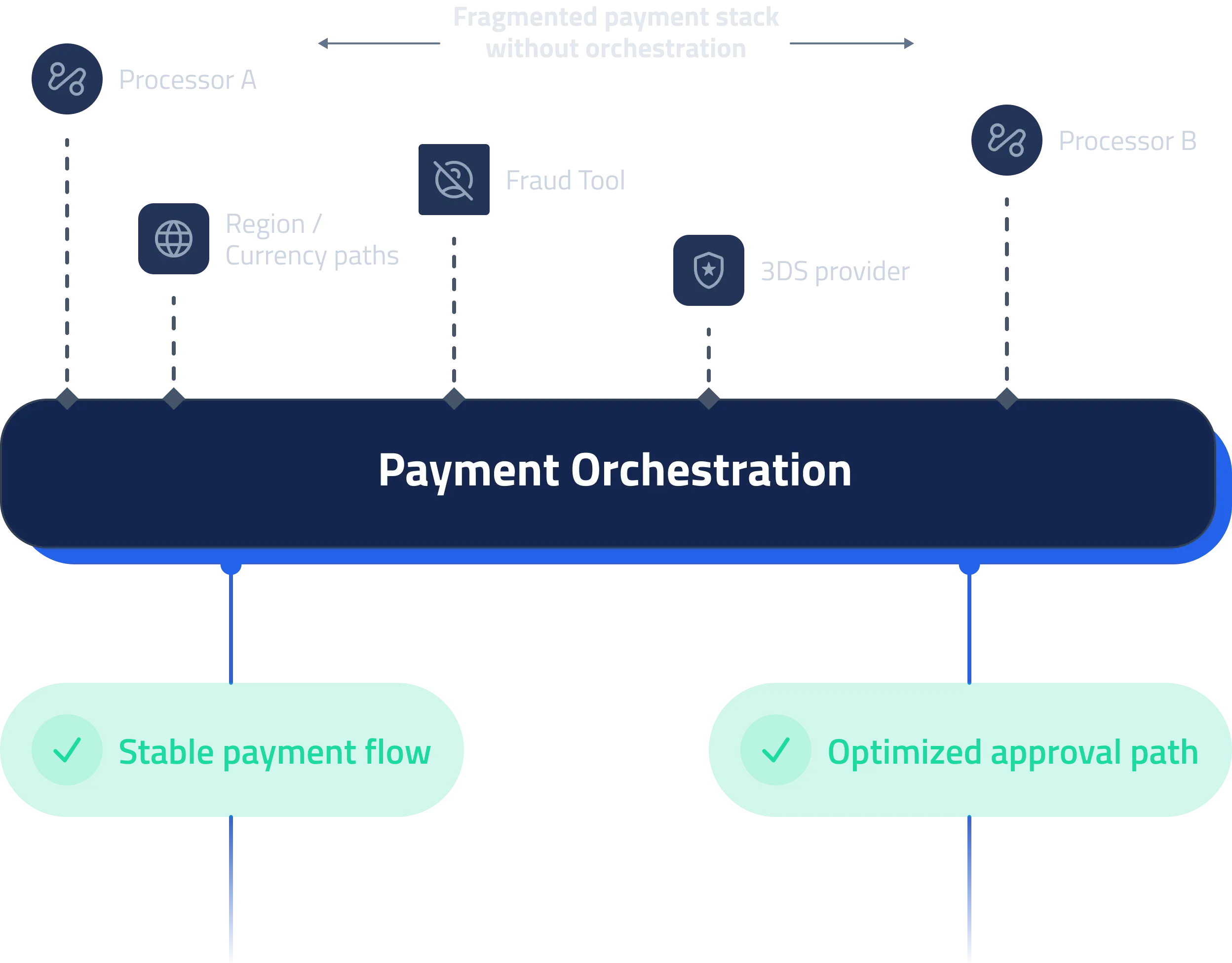

What Is Payment Orchestration?

Payment orchestration is a control layer that sits above your processors, gateways, and payment tools.

Instead of:

Your application → One processor

You get:

Your application → Orchestration layer → Many processors & tools

This allows you to:

- Route transactions dynamically

- Fail over if a processor is down

- Optimize for approvals

- Apply risk rules

- Stay portable and flexible

Why Payment Orchestration Exists

Most businesses eventually hit one or more of these problems:

- Approval rates stagnate or drop

- One processor performs better in some regions than others

- Risk teams block growth

- A processor suddenly terminates or restricts the account

- Migration becomes terrifying and expensive

The lack of orchestration becomes especially dangerous for:

- High-risk businesses

- Subscription businesses

- Marketplaces

- Global companies

Orchestration exists to remove single points of failure from your revenue engine.

What Payment Orchestration Is NOT

Payment orchestration is not:

- Just a gateway

- Just a switch

- Just a load balancer

- Just a routing rule engine

Real orchestration also controls:

- Tokenization

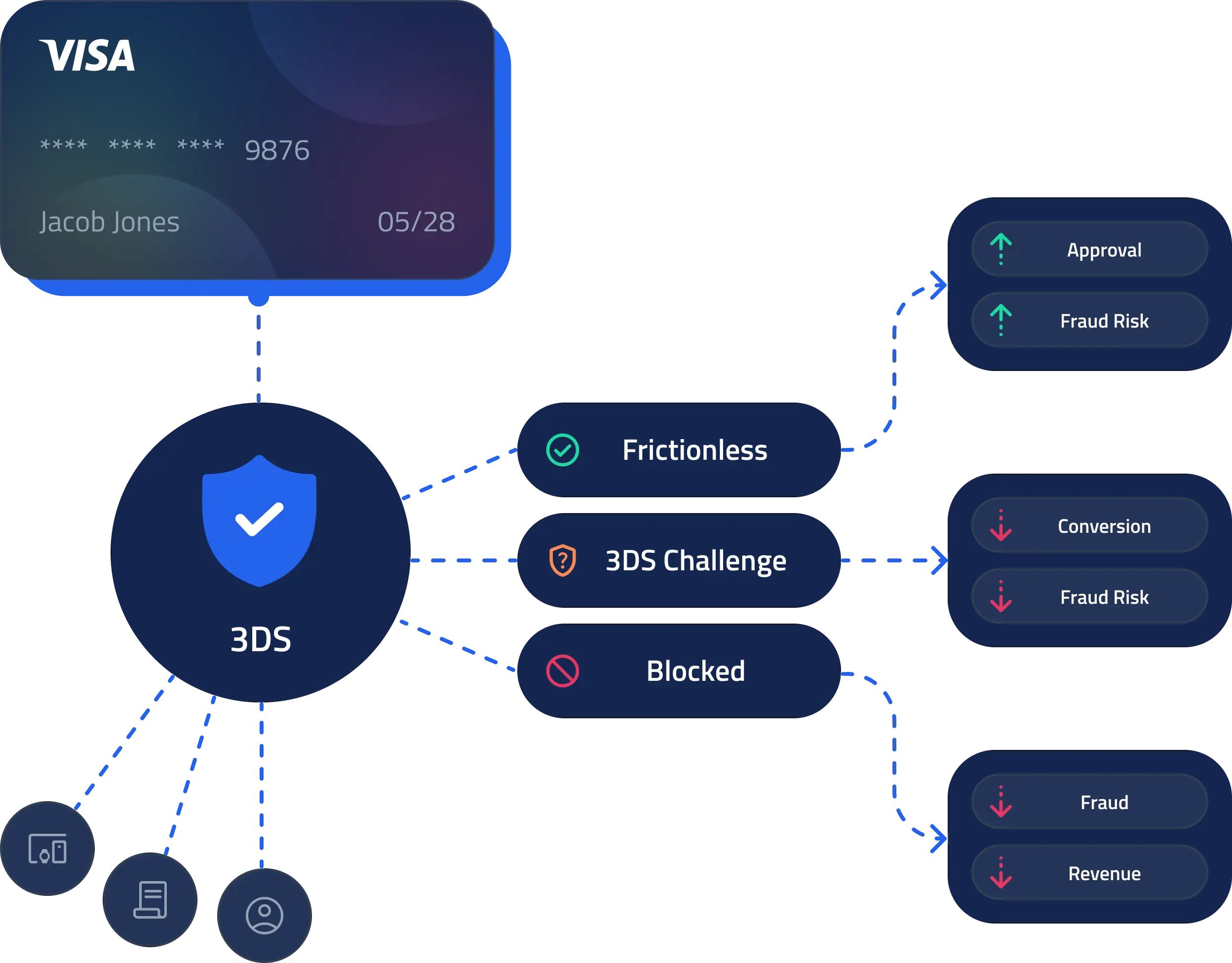

- 3D Secure

- Fraud decisions

- Chargeback prevention

- Retry logic

- Provider performance

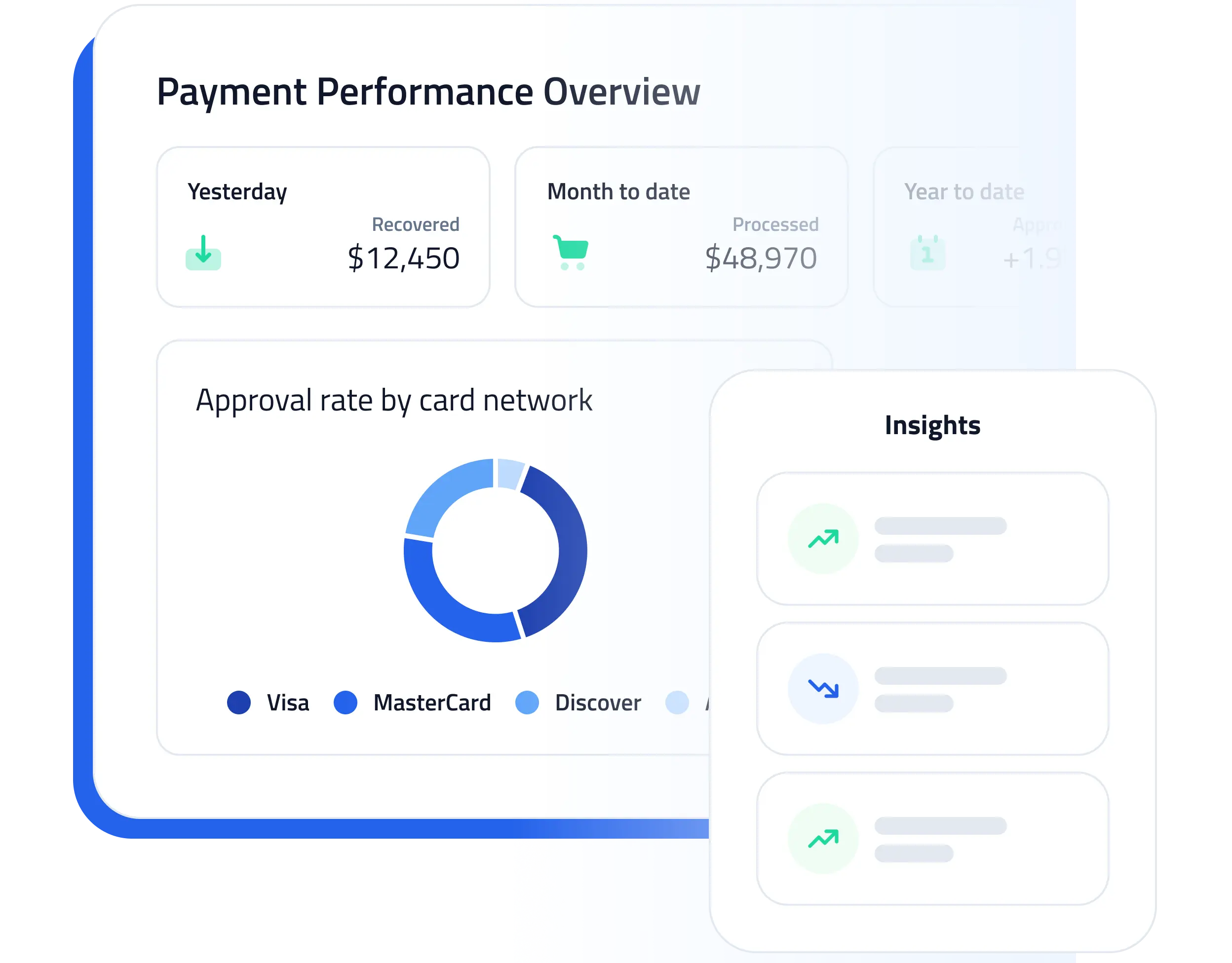

How Payment Orchestration Improves Approval Rates

1. Smart Routing

Route transactions based on:

- BIN / issuer

- Geography

- Card type

- Past performance

(See smart routing guide)

2. Processor Optimization

Different processors approve different traffic better.

Orchestration lets you:

- Send the right transaction to the right provider

- In real time

3. Retry & Decline Recovery

Some declines are soft and recoverable.

Orchestration lets you:

- Retry

- Re-route

- Recover revenue

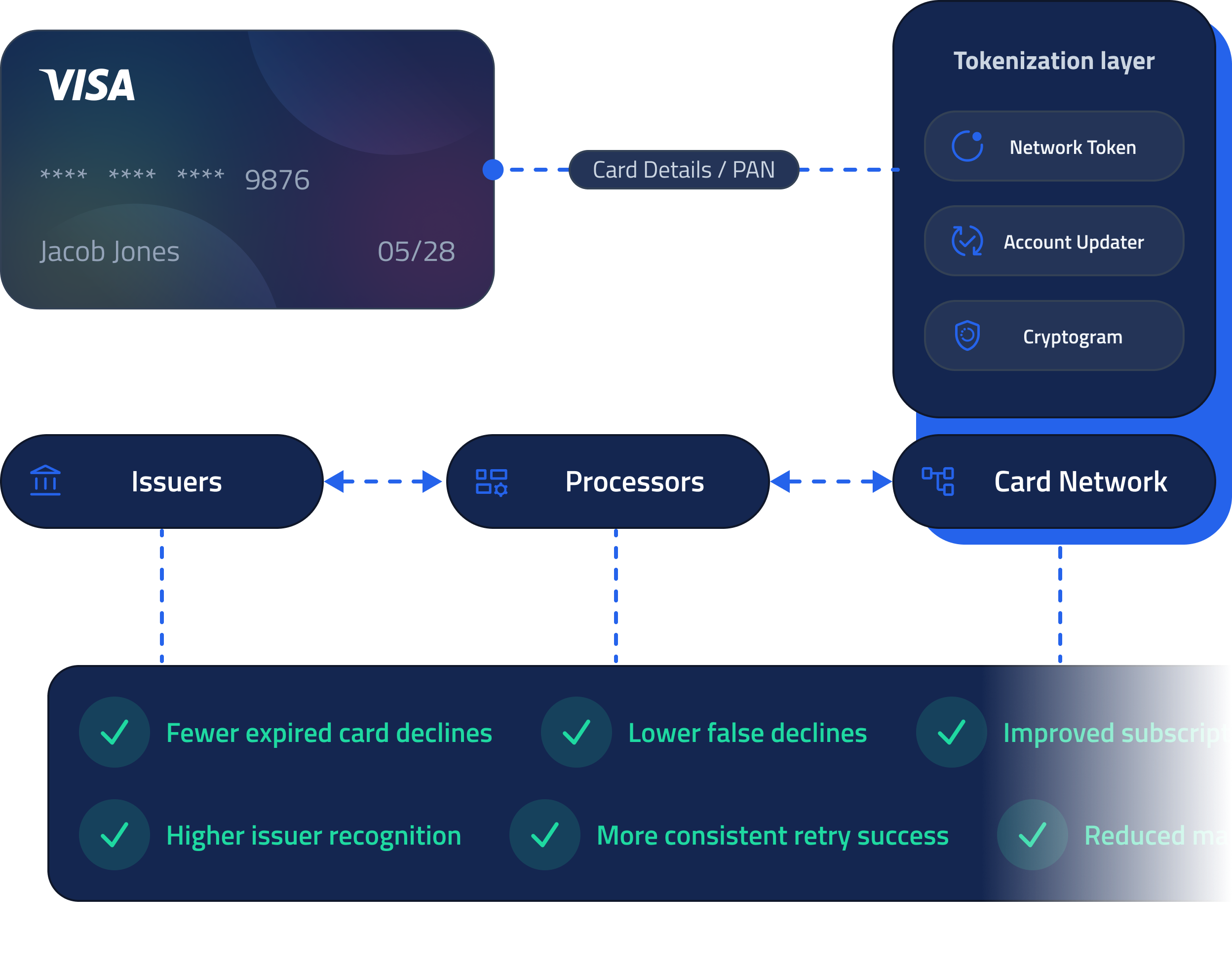

4. Network Tokens

Using network tokens increases issuer trust and approvals.

How Payment Orchestration Reduces Risk

Orchestration is not just about growth — it’s about survivability.

It helps you:

- Apply adaptive 3DS (see 3D Secure guide)

- Control fraud flows

- Segment risky traffic

- Protect chargeback ratios

- Avoid programs like VAMP and Visa monitoring programs

Orchestration and High-Risk Payments

For high-risk merchants, orchestration is not optional.

It provides:

- Multiple acquiring relationships

- Automatic failover

- Traffic shaping

- Risk isolation

- Business continuity if one provider shuts you down

Orchestration and Tokenization

If your tokens are locked to one PSP:

- You are not really orchestrating

- You are just switching

Real orchestration requires:

- Portable tokens

- Or network tokens

- A universal vault strategy

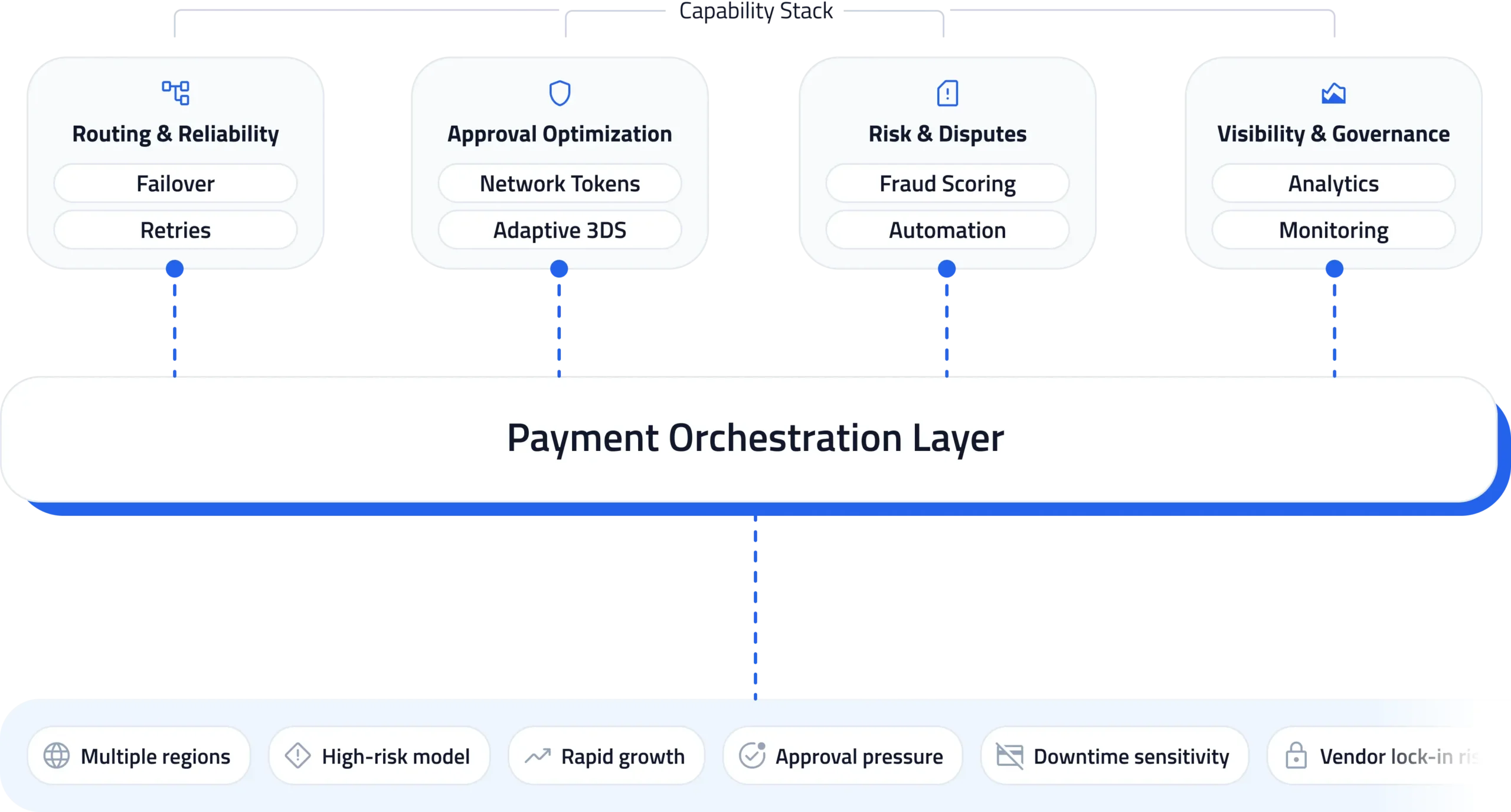

The Modern Payment Orchestration Stack

A real orchestration layer should include:

- Multi-processor routing & failover

- Portable tokenization

- Network token support

- Retry & recovery logic

- Adaptive 3DS

- Fraud scoring

- Pre-dispute alerts (see Ethoca vs Verifi)

- Dispute automation

- Performance analytics

When Do You Actually Need Orchestration?

You likely need orchestration if:

- You operate in multiple regions

- You are high-risk

- You are growing fast

- You care about approval rates

- You cannot afford downtime

- You want to avoid vendor lock-in

How SeamlessPay Approaches Payment Orchestration

SeamlessPay treats orchestration as part of a payment optimization and decision engine — not just routing.

With SeamlessPay you get:

- Smart multi-processor routing

- Built-in tokenization

- Native 3D Secure

- Integrated chargeback prevention

- Real-time fraud scoring

- Network token support

- High-risk support (see high-risk guide)

- Performance-driven decisioning

How to Start Using Orchestration Without Breaking Everything

Step 1 — Start With Visibility

Run a payment performance audit.

Step 2 — Add It as a Control Layer

Don’t rip and replace.

Step 3 — Start With Routing + Tokens

That’s usually the fastest ROI.

Step 4 — Expand Into Risk & Optimization

Layer in 3DS, fraud, and disputes.