What Are High-Risk Payments?

High-risk payments refer to transactions processed by businesses that banks and card networks consider more likely to generate fraud, disputes, or refunds.

Common characteristics:

- Higher-than-average chargebacks (see chargeback prevention guide)

- Higher fraud rates

- Regulatory or reputational risk

- Subscription or continuity billing

- Cross-border or digital delivery

Because of this, high-risk businesses face:

- More declines

- More reviews

- More reserves

- More sudden account terminations

What Makes a Business High Risk?

1. Your Industry (MCC Risk)

Common high-risk verticals:

- Supplements & nutraceuticals

- Gaming & gambling

- Travel & ticketing

- Marketplaces

- Digital goods & info products

2. Your Business Model

- Subscriptions

- Free trials

- Continuity billing

- Marketplaces

- Pre-orders or delayed fulfillment

3. Your Metrics

- High decline rates (see how to increase approval rates)

- High dispute ratios

- High refund rates

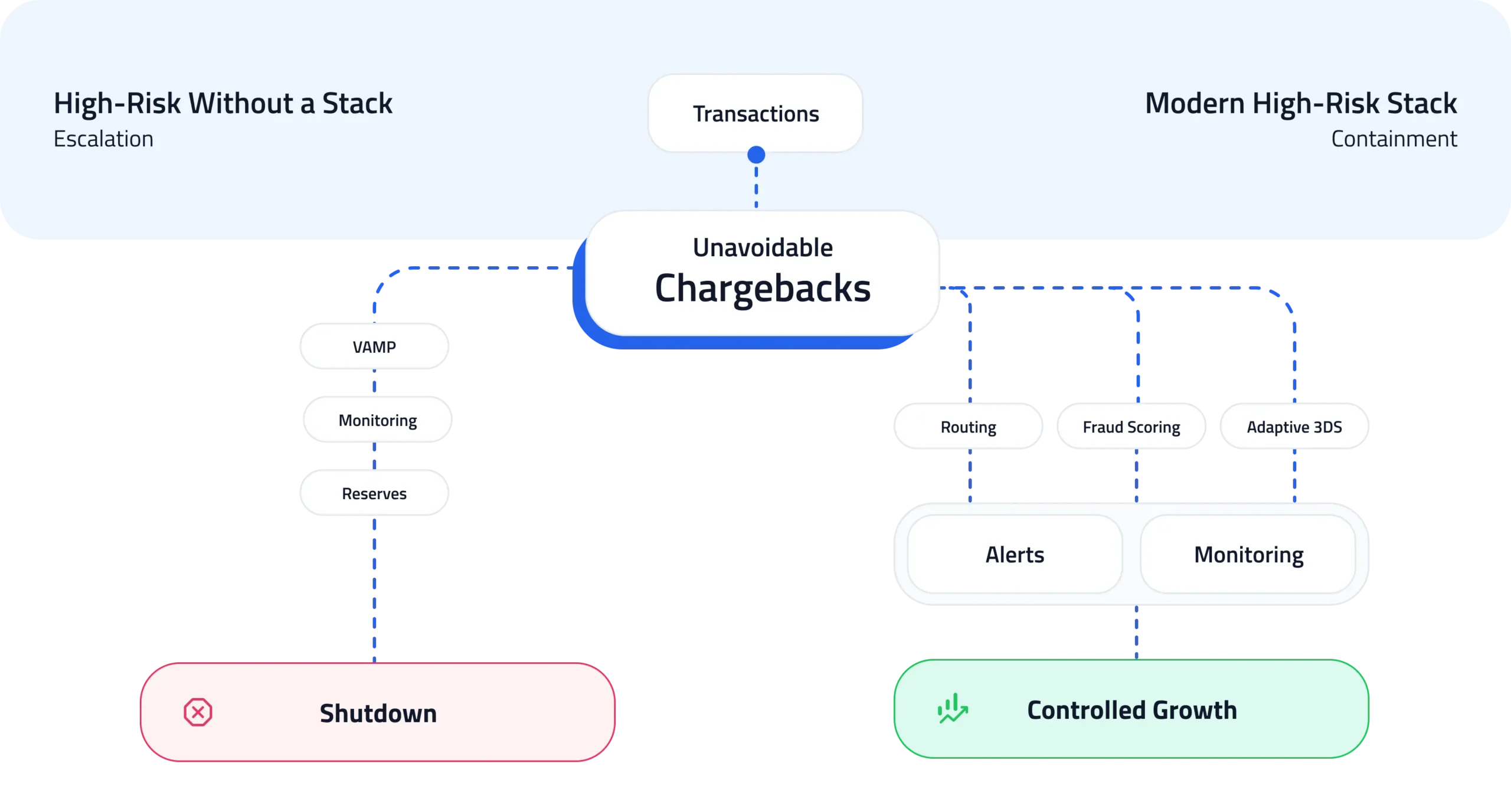

Why High-Risk Merchants Get Shut Down

Most shutdowns happen because of:

- Rising chargebacks (see chargeback prevention guide)

- Being placed into Visa monitoring programs

- Sudden fraud spikes

- Business model changes

- Scaling too fast without proper controls

Processors are risk managers first, not growth partners.

The Hidden Cost of Being High Risk

High-risk merchants pay more in:

- Processing fees

- Reserves

- Declines

- Lost revenue from blocked growth

And often lose:

- Their payment provider

- Their ability to scale

- Sometimes their entire business overnight

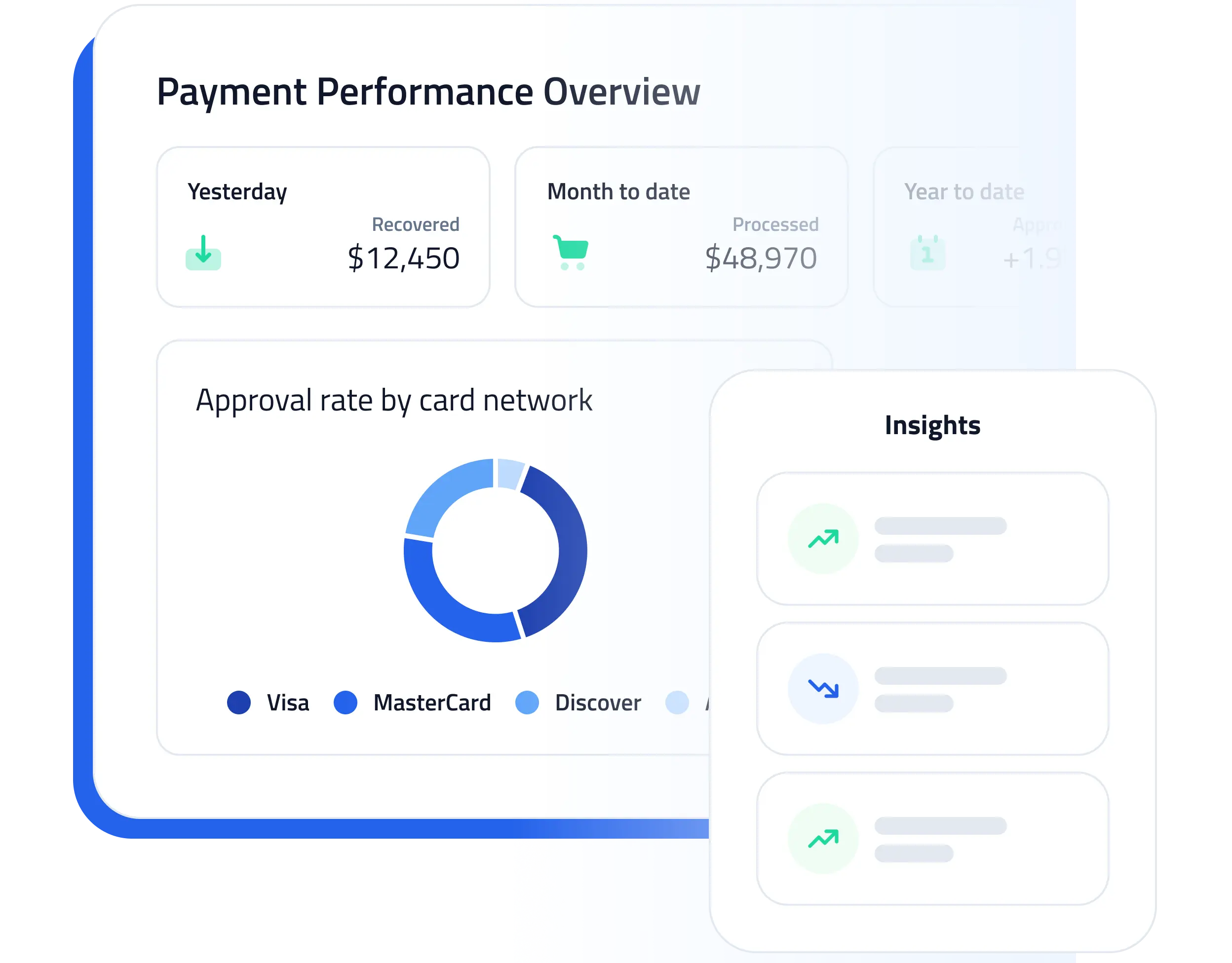

How to Increase Approval Rates for High-Risk Payments

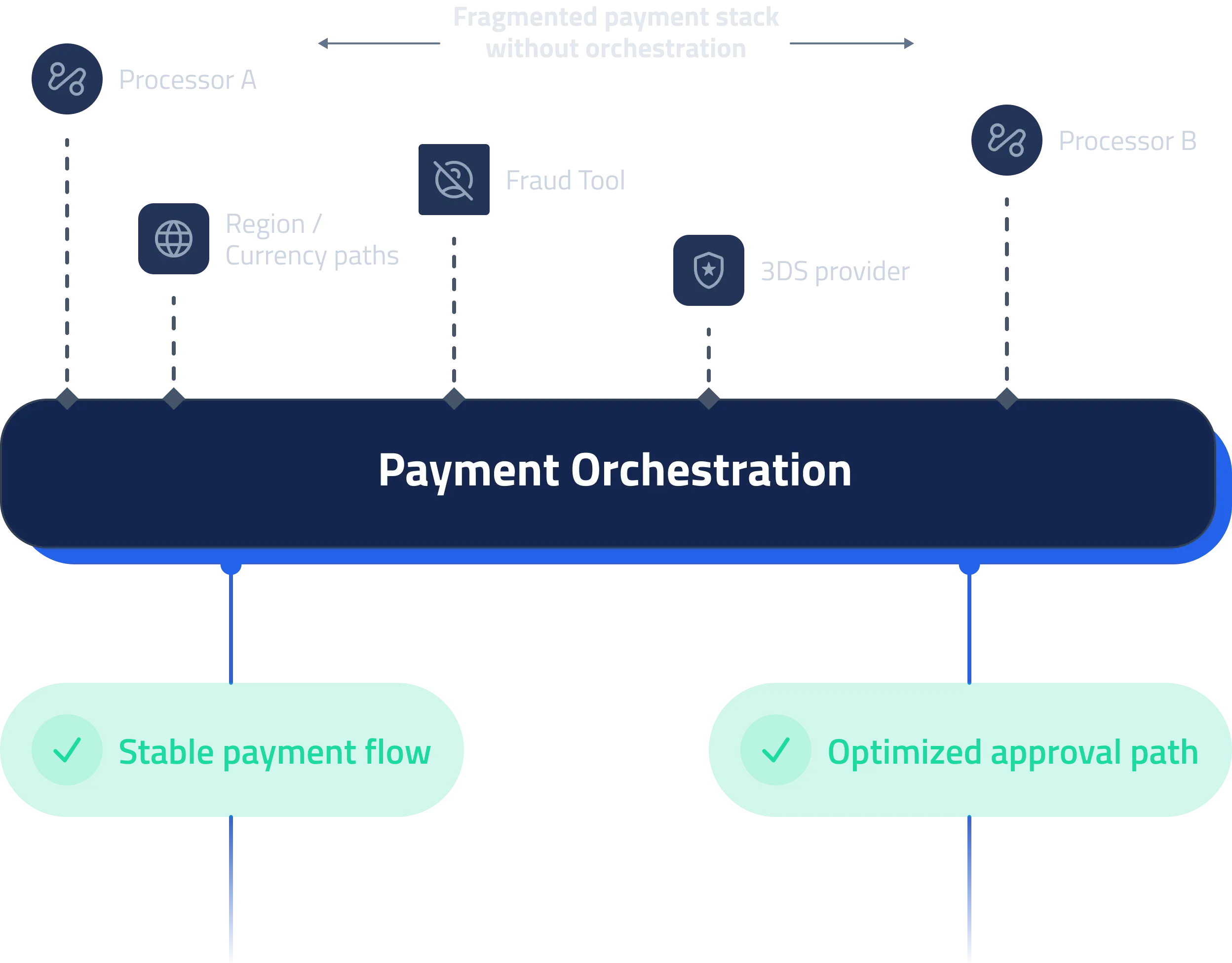

1. Use Smart Payment Routing

Routing transactions to the processor most likely to approve them can lift approvals significantly. (See smart routing guide).

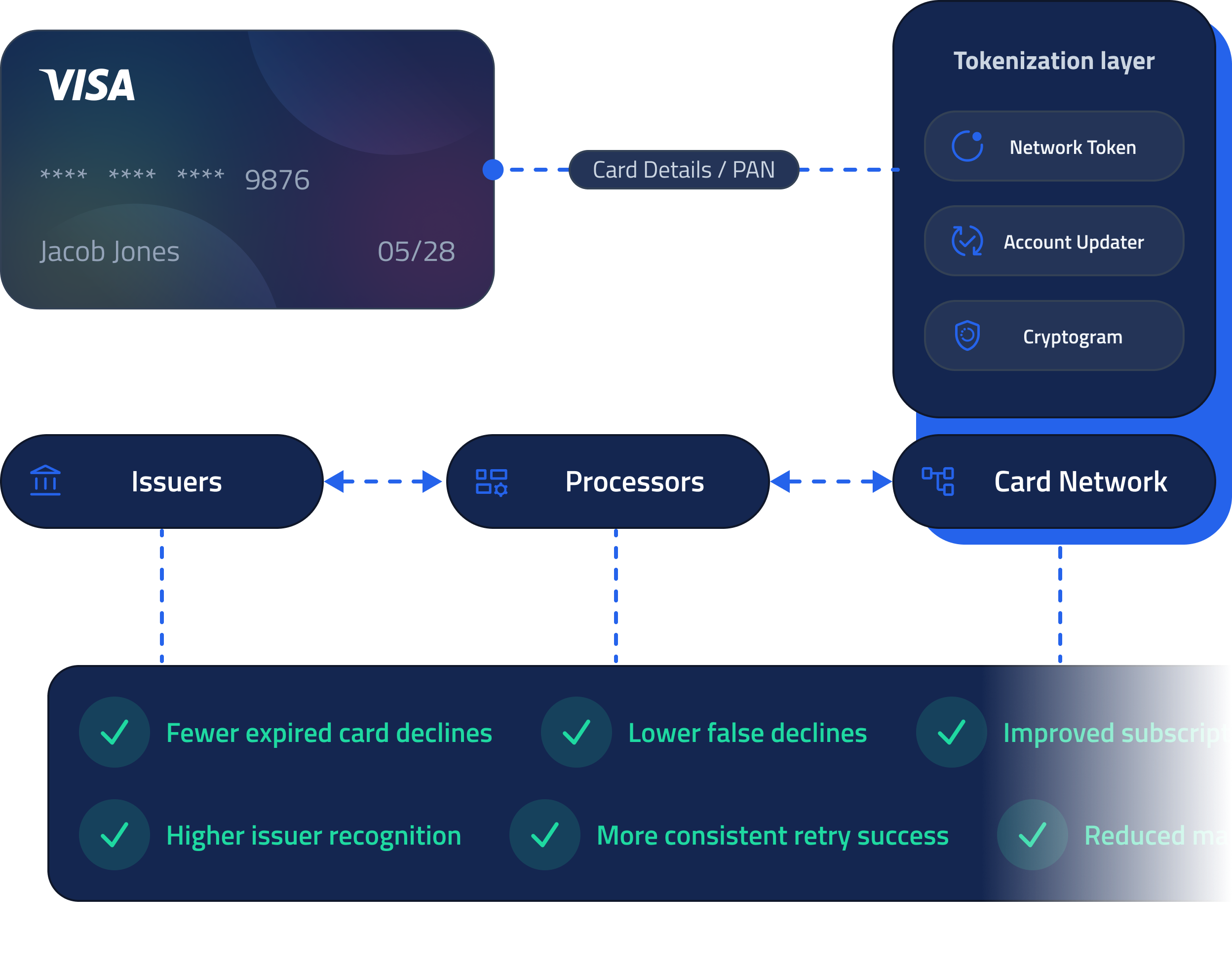

2. Use Network Tokens

Network tokens improve trust with issuers and reduce unnecessary declines.

3. Use Account Updater

Keeps expired cards working and prevents avoidable declines.

4. Use Smart Payment Routing

Not all declines are final — intelligent retries matter.

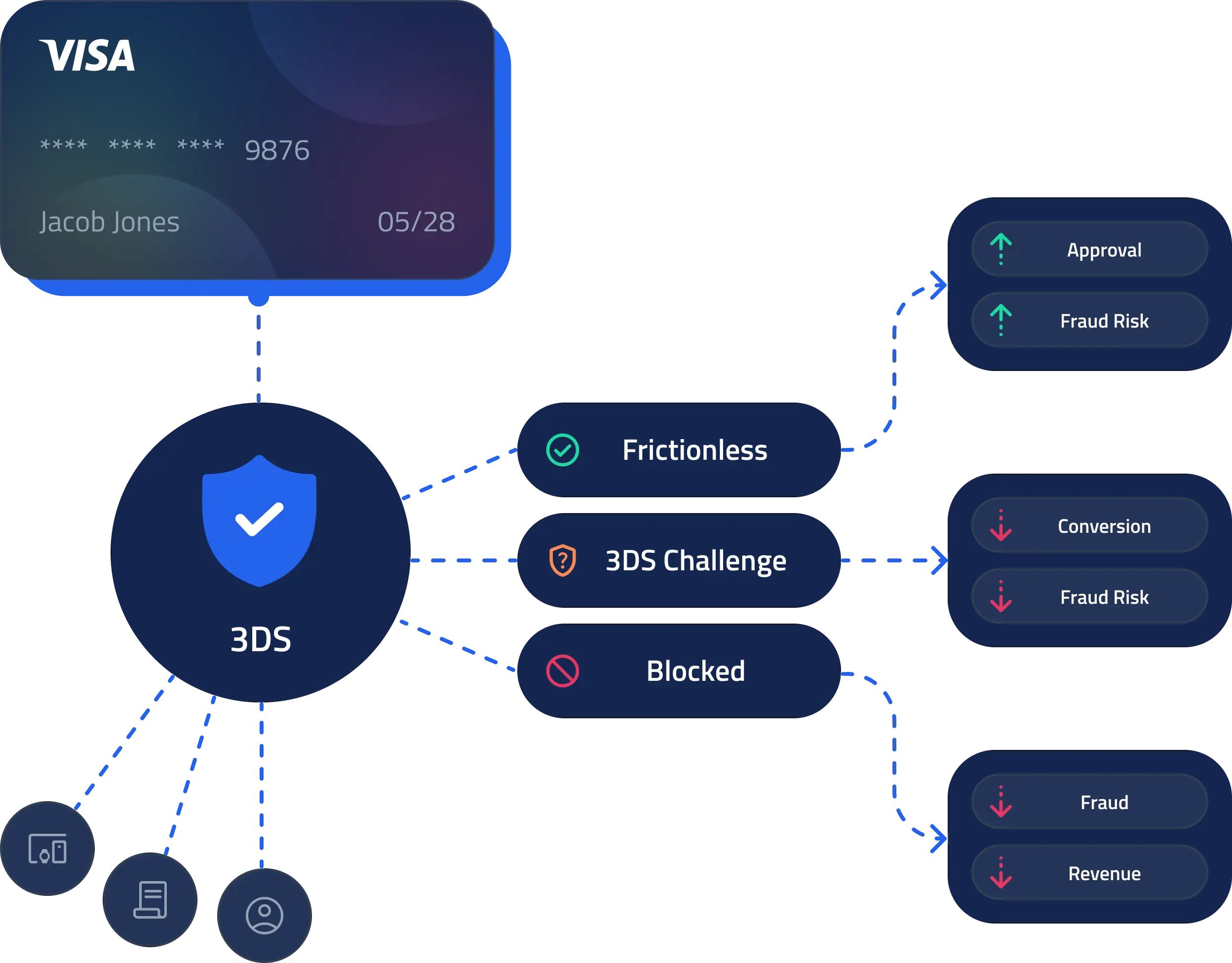

How to Reduce Disputes Without Killing Conversion

Use Adaptive 3D Secure

Instead of forcing 3DS on every transaction, use adaptive 3D Secure only when risk is high.

Use Real-Time Fraud Scoring

Block bad traffic before it becomes disputes.

Use BIN & Geo Controls

Shape traffic instead of blanket blocking countries or cards.

Why Chargebacks Are Extra Dangerous for High-Risk Businesses

High-risk merchants hit network thresholds faster.

That means:

- Faster entry into VAMP

- Faster placement into Visa monitoring programs

- Faster shutdowns

This is why chargeback prevention is not optional for high-risk businesses.

The Modern High-Risk Payments Stack

A real high-risk stack should include:

- Multiple processors (no single point of failure)

- Smart routing

- Network tokens

- Adaptive 3DS

- Fraud scoring

- Pre-dispute alerts (see Ethoca vs Verifi)

- Dispute automation

- Monitoring & alerts

How SeamlessPay Helps High-Risk Merchants Scale

SeamlessPay is built for high-risk and high-growth businesses that can’t afford processor lock-in.

With SeamlessPay you get:

- Multi-processor routing & failover

- Network tokens (see tokenization guide)

- Adaptive 3DS (see 3D Secure guide)

- Real-time fraud scoring

- Pre-dispute deflection

- AI-powered dispute responses

- Monitoring for VAMP and network programs