Calculate Your VAMP Risk

RESULTS*

0

You are in the High Risk zone and at serious risk of being placed into Visa monitoring programs.

Accounts at this level commonly face higher fees, reserves, or operational restrictions unless dispute levels are reduced quickly.

Immediate action is recommended to prevent escalation and protect your ability to process payments.

0

You are above standard and approaching Visa’s monitoring thresholds.

At this level, even small increases in disputes can quickly push your account into formal monitoring or penalty programs.

This is typically the lowest-cost window to take corrective action before higher fees, reserves, or restrictions apply.

0

You are in the Early Warning zone and approaching Visa’s monitoring thresholds.

While you are not currently in a monitoring program, issuers and acquirers may begin increasing scrutiny at this level.

This is an early signal to review dispute drivers and strengthen prevention before risk escalates further.

0

You are currently below Visa’s monitoring thresholds.

Your dispute levels are considered low risk today, and your account is operating within acceptable ranges for Visa and acquirers.

As volume grows, continued monitoring and proactive dispute prevention are important to maintain this position and avoid drifting into higher-risk territory.

*Results are indicative estimates based on your inputs and commonly referenced card network monitoring thresholds.

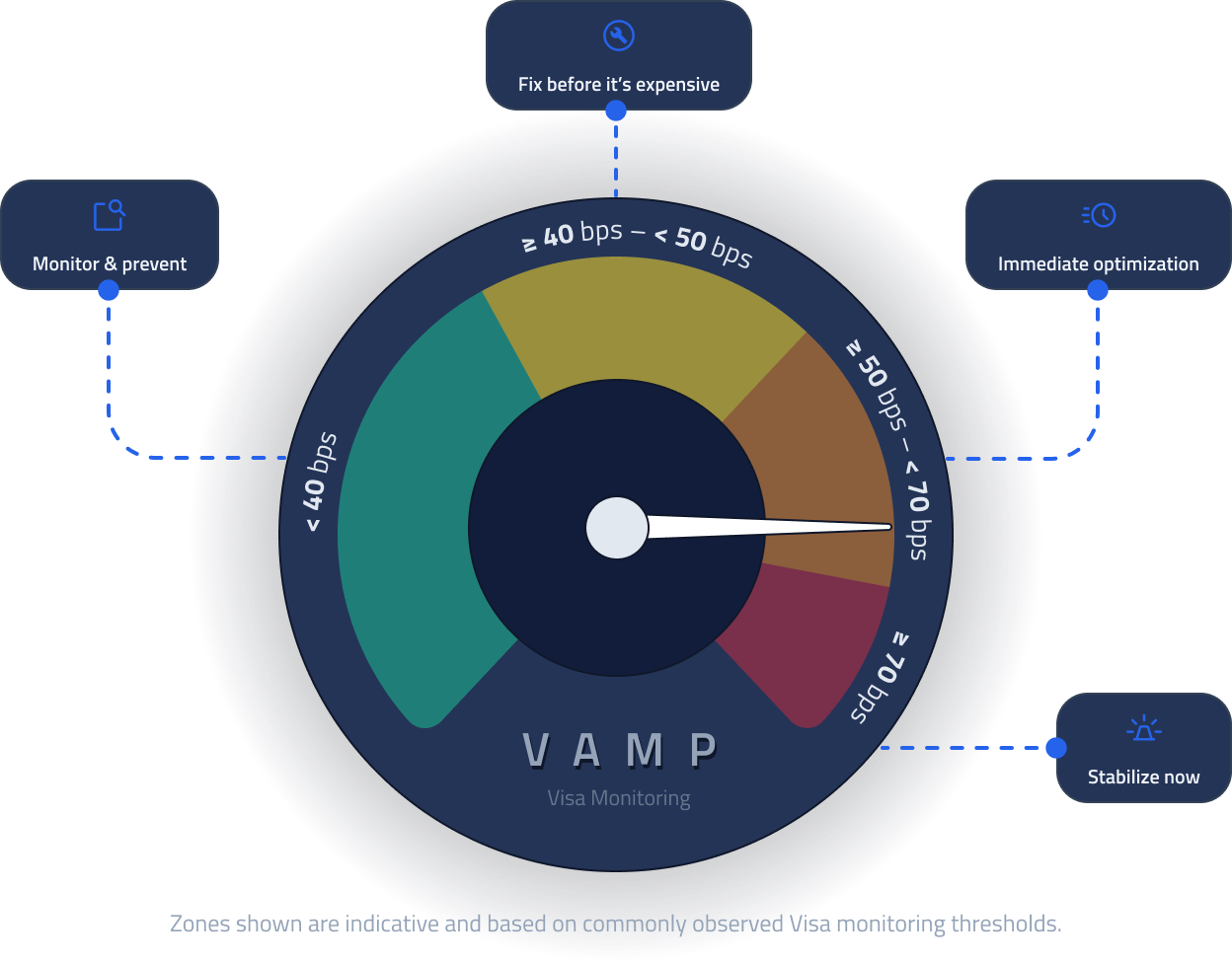

What Your VAMP Score Means

- Safe (Below 40bps)

- You are currently below Visa’s monitoring thresholds

- Your dispute levels are considered low risk at this volume.

- You should still focus on chargeback prevention to stay safe as you scale

- Early Warning (40–50bps)

- You are approaching Visa’s monitoring thresholds

- At this level, even small increases in disputes can raise issuer and acquirer scrutiny.

- This is the best time to act, before any penalties or monitoring begin.

- Above Standard (50–70bps)

- Your dispute ratio is above Visa’s standard expectations.

- Accounts in this range are commonly flagged for increased risk review

- Without corrective action, escalation into monitoring programs is likely.

- Active optimization is strongly recommended to avoid fees or restrictions.

- High Risk Zone (≥ 70 bps)

You are at serious risk of:- Higher processing fees

- Reserve requirements

- Account restrictions or shutdown

You may already be in or entering Visa monitoring programs.

Immediate action is required to stabilize risk and protect payment continuity.

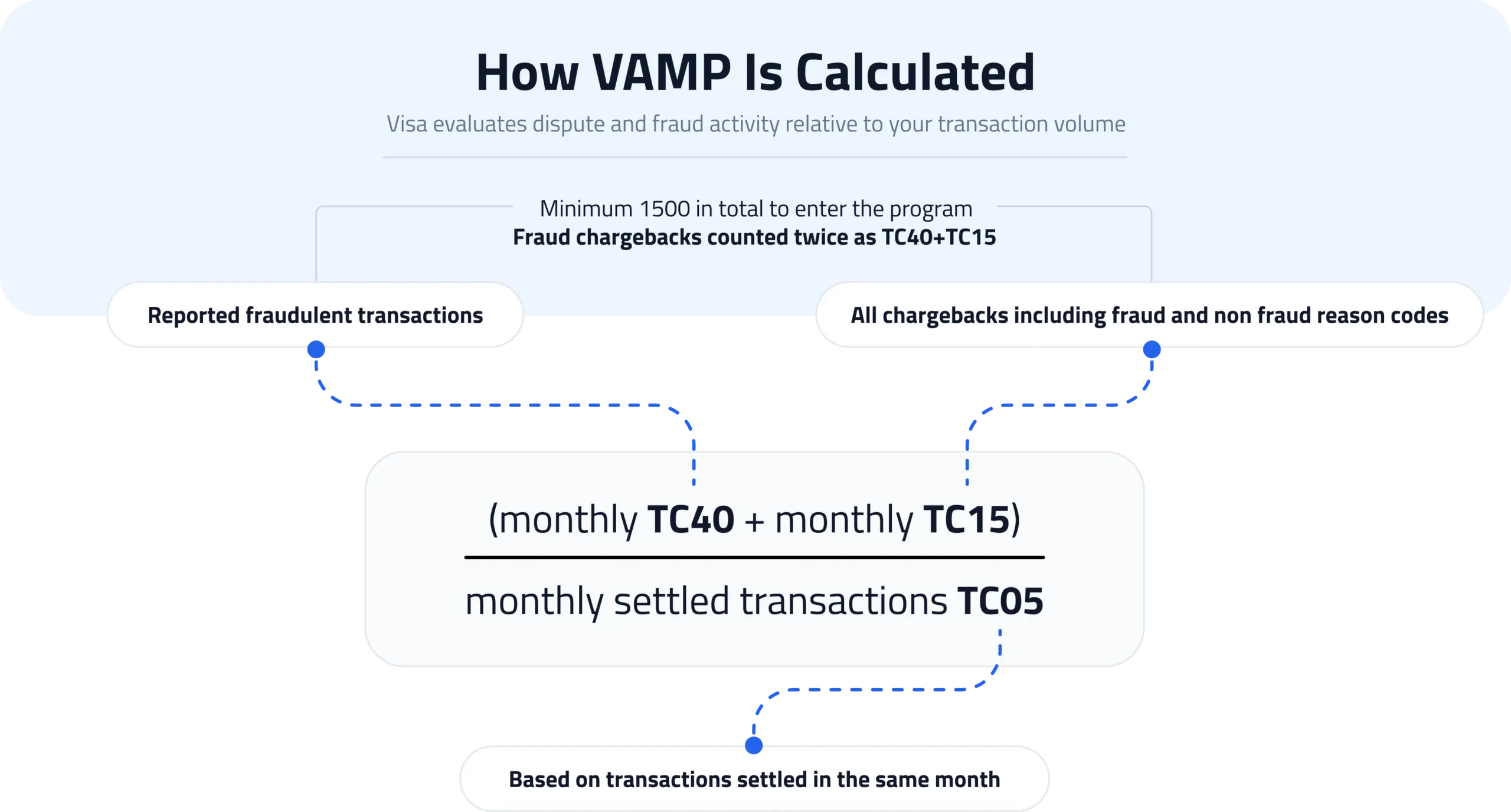

What Is VAMP?

VAMP stands for Visa Acquirer Monitoring Program. It’s how Visa tracks merchants with:

- High dispute ratios

- High fraud

- Poor transaction quality

Merchants who exceed thresholds are placed into monitoring programs that can:

- Increase fees

- Lower approval rates

- Force reserves

- Or terminate accounts entirely

Why You Should Take This Seriously

If your VAMP ratio keeps rising:

- Your processor may limit or shut down your account

- Approval rates often drop

- Your business becomes harder to place with acquirers

- Scaling becomes extremely difficult

This is especially dangerous for:

- High-risk businesses

- Subscription companies

- Marketplaces

How to Lower Your VAMP Score

Real fixes include:

- Pre-dispute alerts (Ethoca & Verifi)

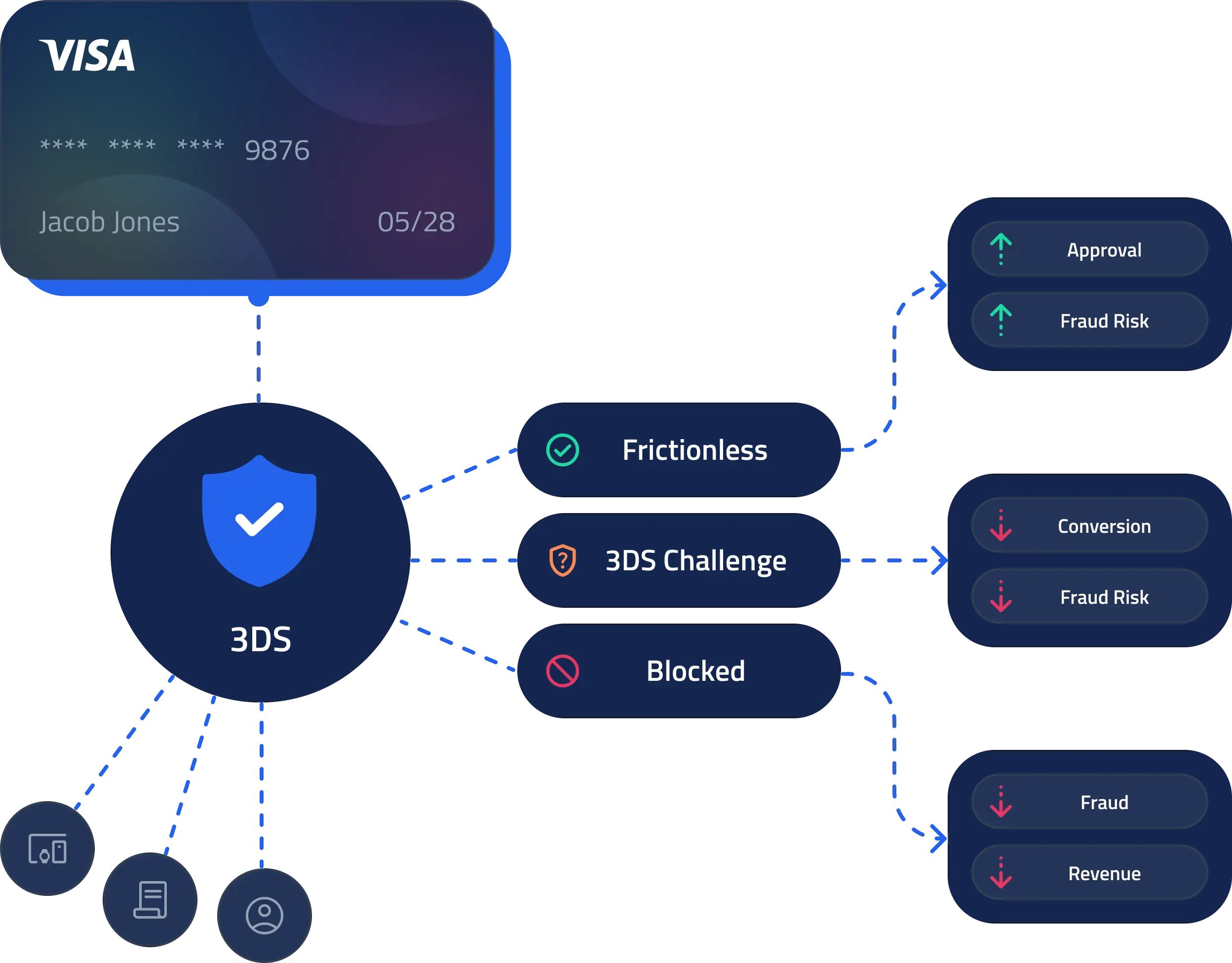

- Adaptive 3D Secure

- Better fraud filtering

- Cleaner refund flows

- Chargeback prevention strategy

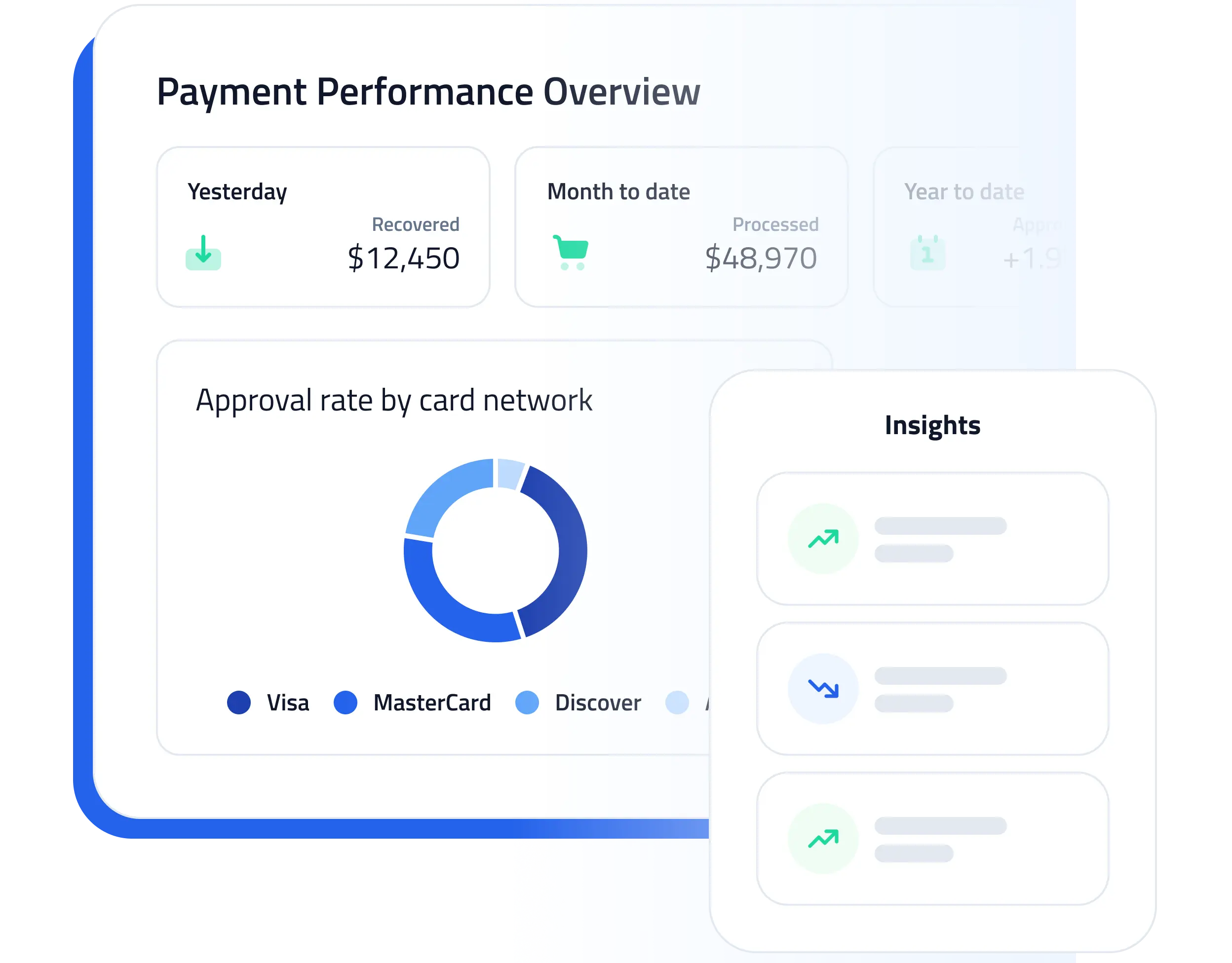

How SeamlessPay Keeps You Out of Monitoring Programs

SeamlessPay is a payment optimization and risk control platform that helps:

- Reduce fraud

- Stop disputes before they become chargebacks

- Automate responses

- Monitor VAMP and network thresholds

- Protect approval rates

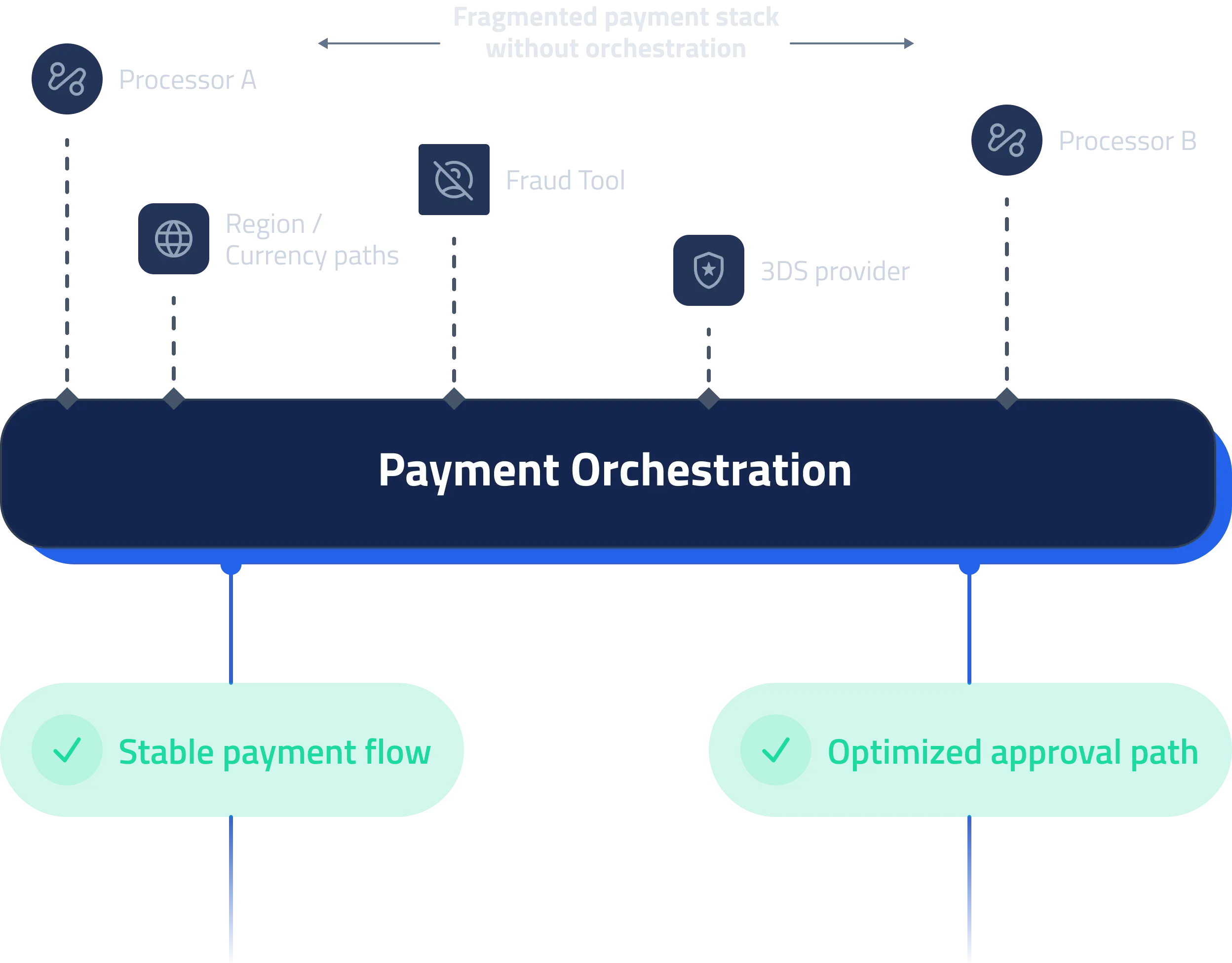

Used together with:

- Tokenization

- Smart routing

- Payment orchestration