Compare Your Approval Rate

RESULTS*

86%

93.8%

You’re performing above the industry benchmark.

Your approval rate is strong compared to similar businesses, which means you’re already capturing most available revenue. That said, even top performers often uncover incremental gains through routing, issuer strategy, and risk tuning.

If you want to pressure-test your setup, we can help identify where further upside may exist.

You’re currently at the industry benchmark.

This is a solid baseline, but it often hides avoidable declines caused by routing inefficiencies, issuer behavior, or overly conservative risk settings.A closer look can help uncover opportunities to improve approvals safely.

You may be missing approximately:

- $0 per month

- $0 per year

in revenue that could be recovered by improving approval rates toward the industry average.

*Results are indicative only and based on aggregated industry benchmarks.

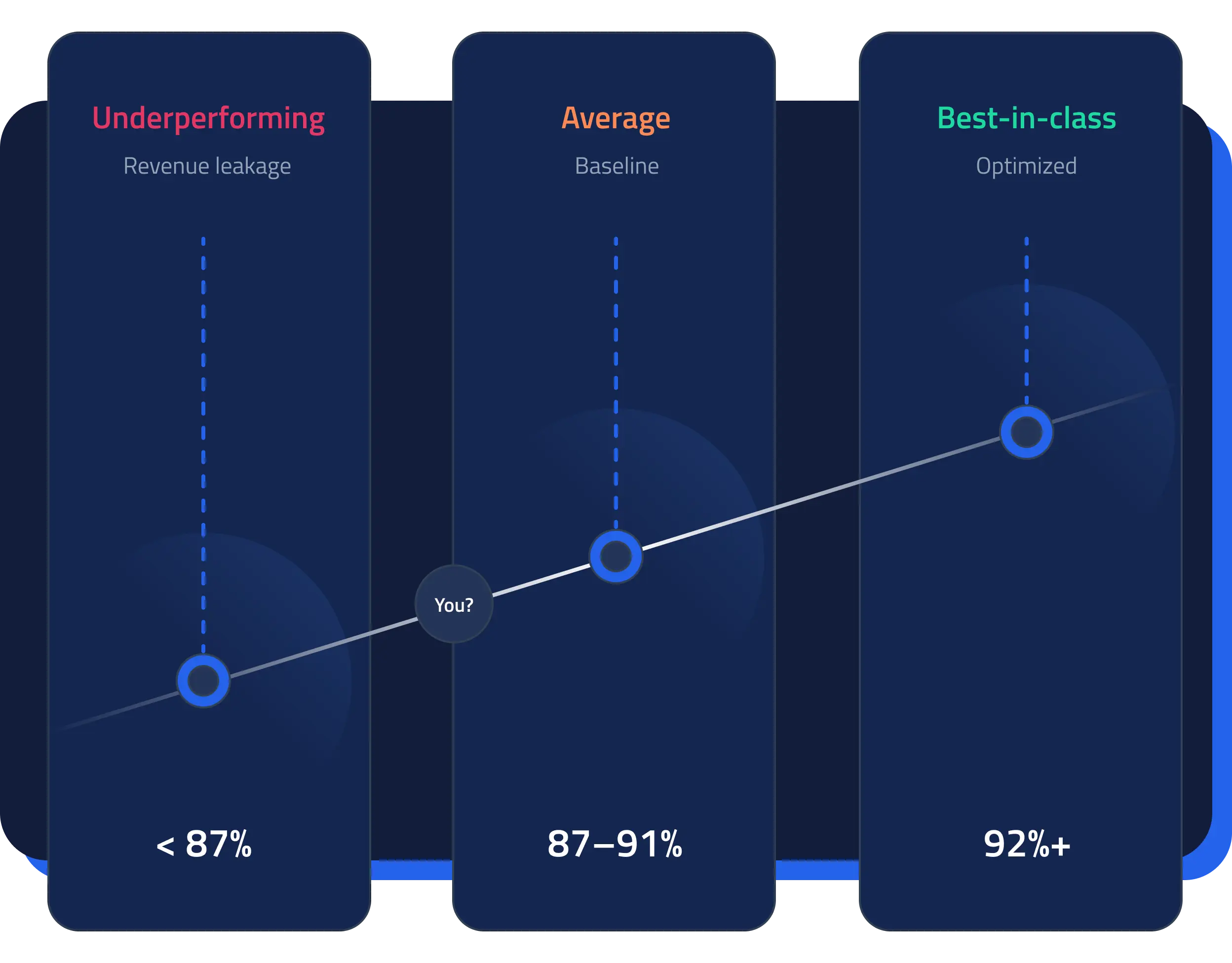

What Is a Good Payment Approval Rate?

There is no single “perfect” number, but general benchmarks look like:

- Best-in-class: 92% – 96%+

- Average: 87% – 91%

- Underperforming: Below 87%

For high-risk businesses:

- Even 74%+ can be competitive

Approval Rates Are the Most Important Revenue Metric You’re Not Watching

Every 1% improvement in approval rate can mean:

- 1%–3% more revenue

- Better LTV

- Lower CAC waste

- Better issuer trust

And declining approval rates usually signal:

- Bad routing

- Weak payment signals

- Risk systems over-blocking

- Token problems

- Processor mismatches

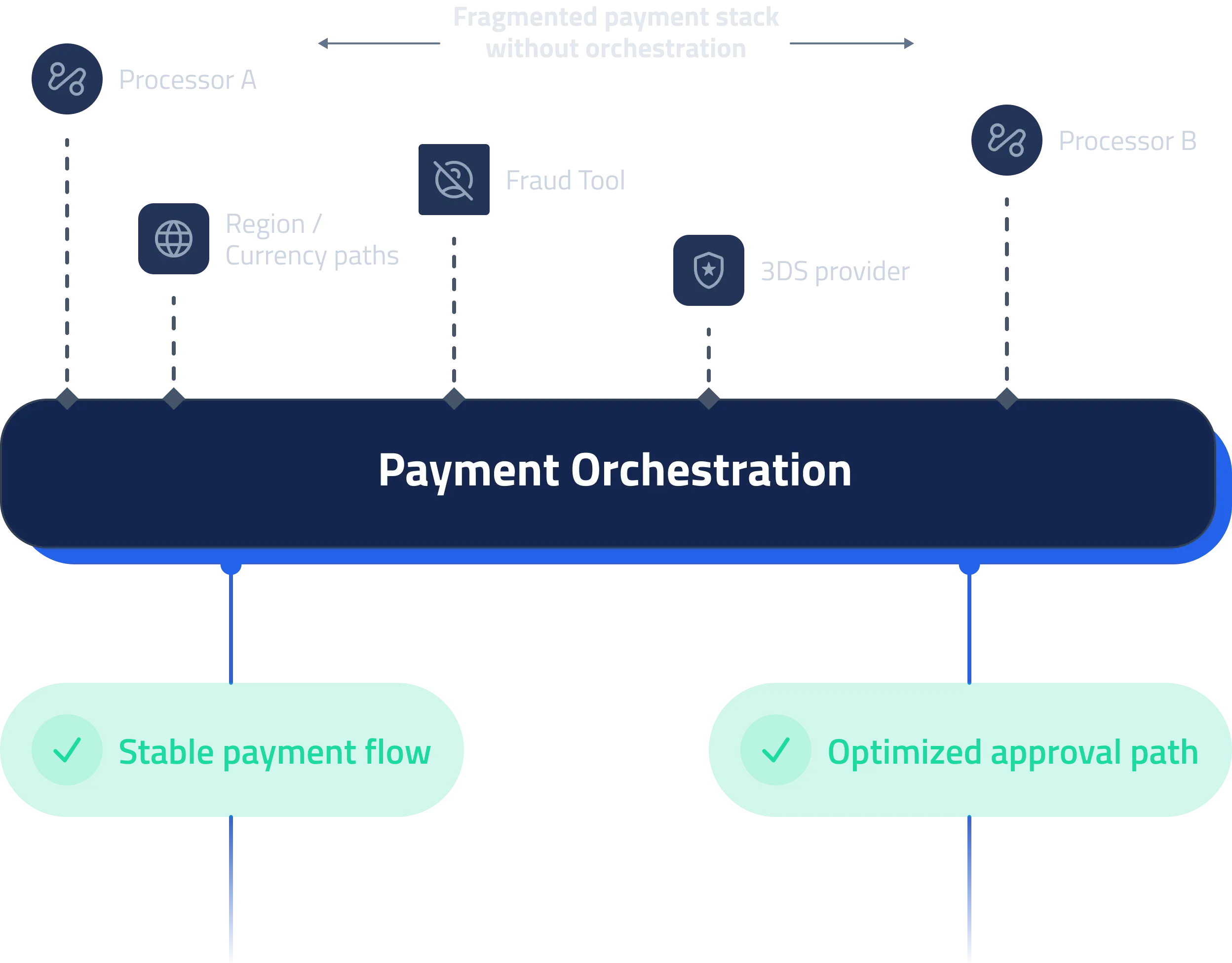

Why Most Businesses Slowly Start Declining More Transactions

Common causes:

- Scaling into new regions

- More issuer scrutiny

- Rising fraud

- Rising chargebacks

- Being flagged in programs like VAMP or Visa monitoring programs

- Being locked into a single processor

How Top Merchants Get to 93%+ Approval Rates

Real improvements come from:

- Smart routing

- Network tokens

- Account updater

- Better retry logic

- Better fraud decisions (not over-blocking)

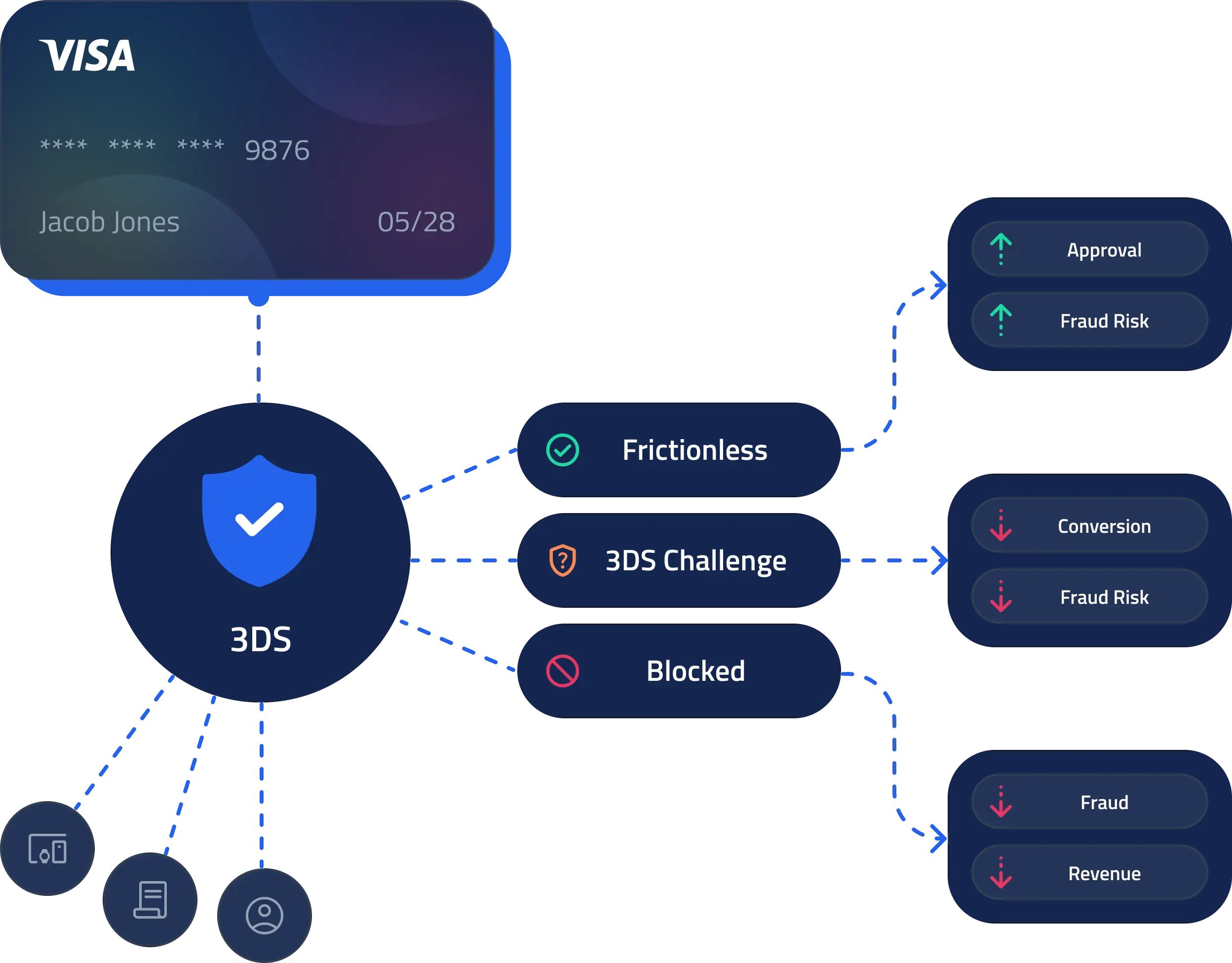

- Adaptive 3D Secure

- Payment orchestration

Bad Risk Management Kills Approval Rates

When:

- Fraud is high

- Disputes rise

- Ratios worsen

Issuers:

- Trust you less

- Decline more

- Force more friction

Which is why chargeback prevention and 3D Secure authentication are approval rate optimizers, not just risk tools.

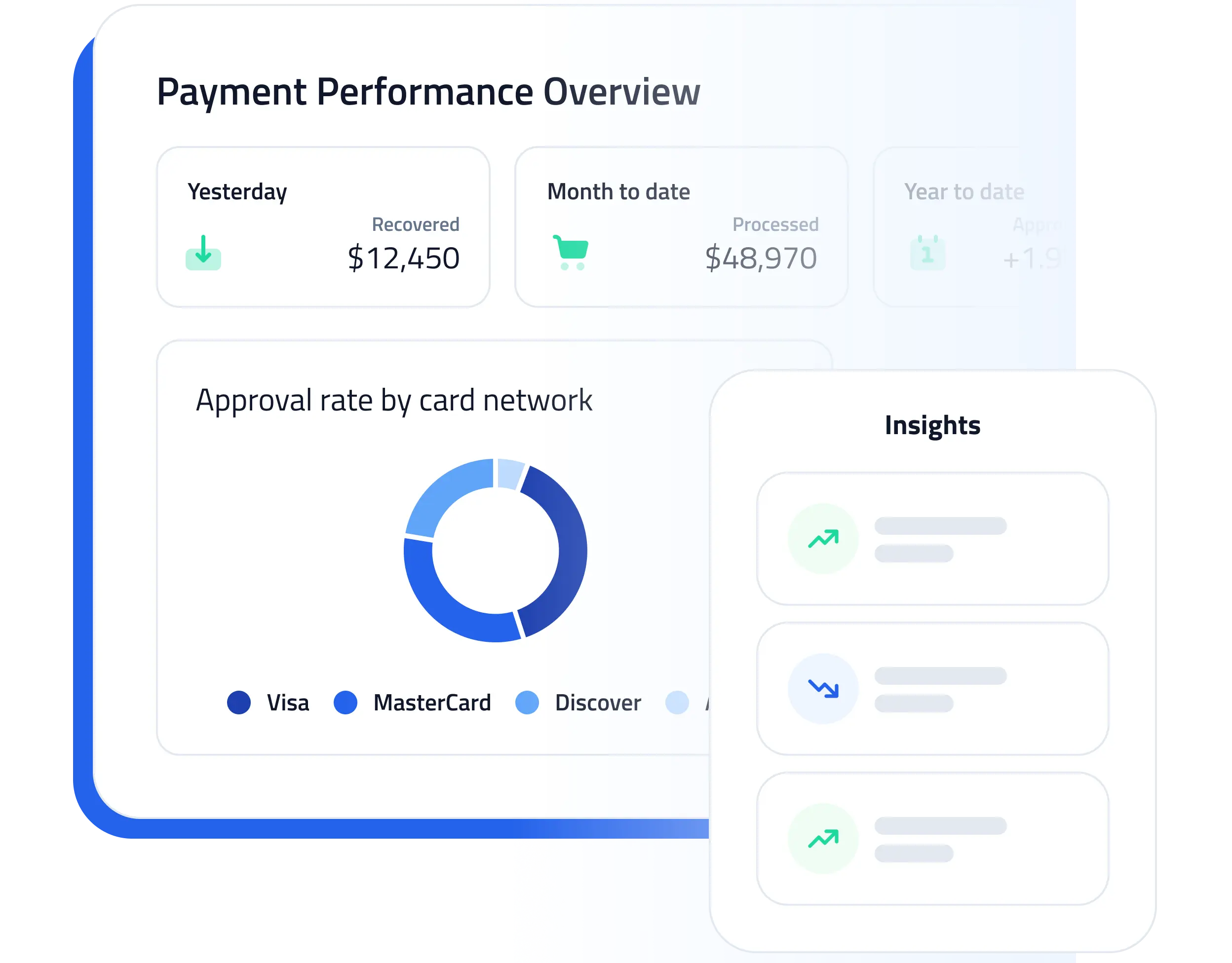

How SeamlessPay Turns Declines Into Revenue

SeamlessPay is a payment optimization platform that improves approvals using:

- Smart multi-processor routing

- Network tokens & portable tokens

- Account updater

- Retry & recovery logic

- Adaptive 3DS

- Fraud & risk tuning

- Built-in orchestration

And protects performance with:

- Chargeback prevention

- Real-time monitoring

- Risk controls