SeamlessPay offers 3D Secure either as a bundled service with payment processing or as a standalone service.

SeamlessPay’s 3DS solution delivers mobile-first, low-friction authentication powered by device intelligence, advanced data sharing, and issuer-trusted identity signals. Reduce fraud by up to 70% and increase approval rates without slowing down your customers.

Block unauthorized transactions with real-time authentication that stops fraudulent chargebacks from occurring.

By sharing richer data with issuers, 3DS increases trust and improves authorization rates on high-intent customers.

Eligible 3DS-authenticated transactions transfer chargeback liability away from your business to the cardholders issuing bank.

Secure your most important payment flows with flexible, low-friction authentication.

Authenticate every online purchase with issuer-trusted identity signals. Reduce fraud and increase approvals while preserving a frictionless checkout.

Send 3DS payment links via email or text directly from SeamlessPay to secure over-the-phone/email transactions. Reduce disputes and protect large-value orders.

Enable fully native 3DS experiences inside your mobile app, including biometrics, push challenges, and fast frictionless flows.

Deliver a frictionless 3DS 2.0 experience with mobile-ready flows, rich data signals, and secure approvals that protect revenue without slowing customers down.

Most transactions authenticate with no customer interaction. Maintain high conversions with invisible, risk-based decisioning.

3DS 2.0 is built for mobile. Support biometrics, push approvals, banking-app challenges, and seamless in-app flows.

Device ID, geolocation, IP, behavior, and more are passed to issuers, enabling smarter approval decisions.

Customers can authenticate using Face ID, Touch ID, or banking-app confirmations for an instant, familiar experience.

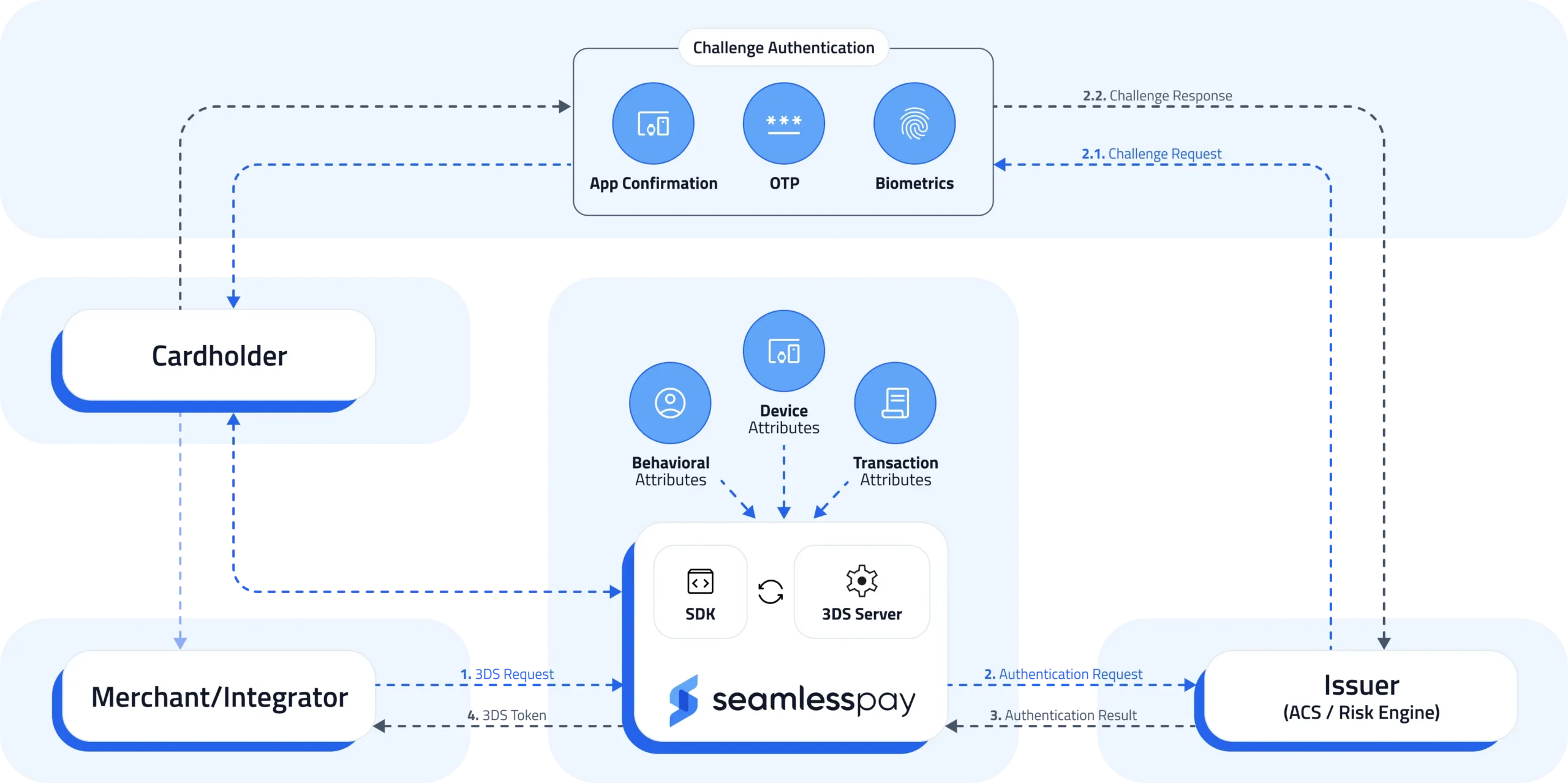

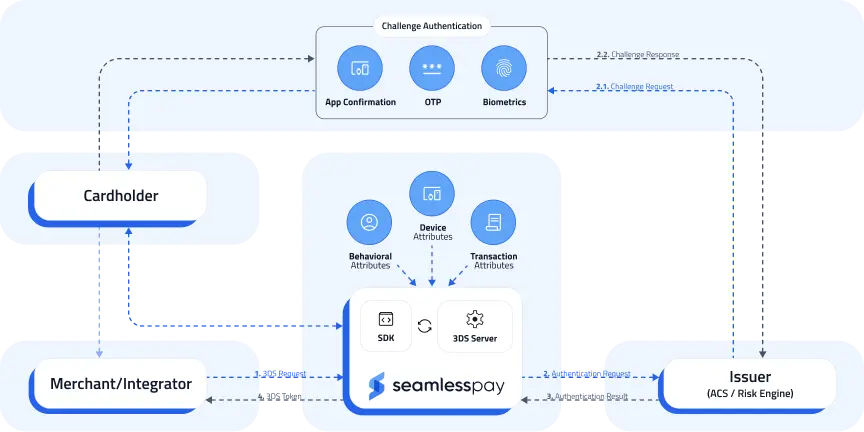

3DS authentication happens in a series of fast, behind the scenes steps that validate identity and keep checkout moving.

SeamlessPay collects device, behavioral, and transaction attributes in real time. These signals help issuers recognize trusted customers early.

The transaction is sent to SeamlessPay’s 3DS Server, where authentication logic classifies the risk profile and prepares the request for the issuer.

The issuing bank evaluates more than 150 shared data points to determine whether the transaction appears legitimate or requires additional verification.

If the issuer trusts the transaction, authentication completes silently. If risk indicators appear, the issuer requests a challenge such as biometrics or an app confirmation.

Possible outcomes:

Frictionless → Authorization

Challenge → Verified → Authorization

Once identity is verified, the transaction moves to authorization with a higher likelihood of approval and stronger fraud protection.

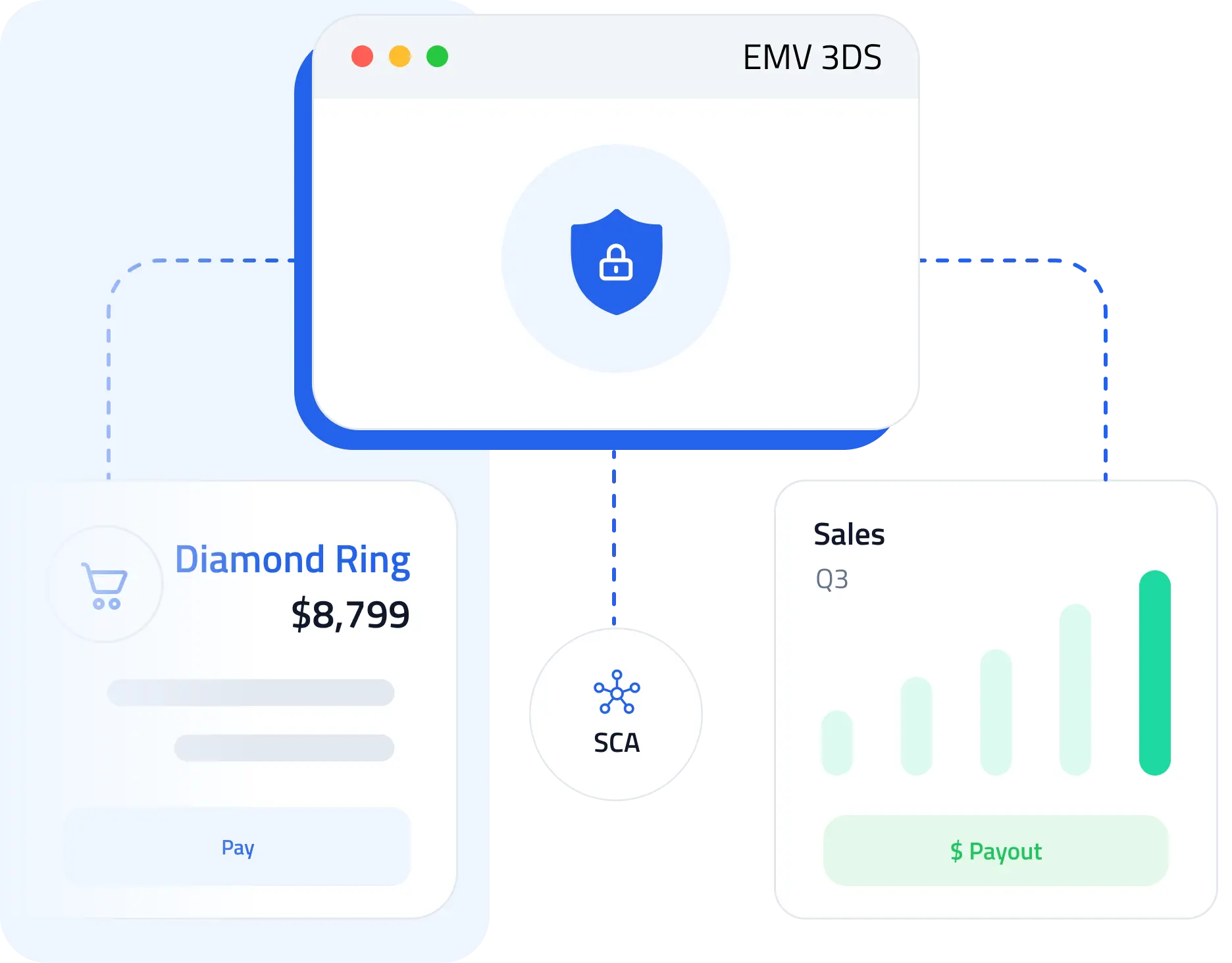

Challenge: A marketplace processing high-ticket goods faced rising fraudulent transactions and revenue losses from false declines.

Solution: SeamlessPay activated EMV 3DS across all card-not-present flows, leveraging rich data exchange, dynamic challenge logic, and automated SCA routing.

EMV 3D Secure is a global authentication standard that verifies customer identity during online card payments.

Yes, 3DS significantly reduces fraud-related chargebacks. With 3DS Liability Shift, the financial responsibility for fraud-related chargebacks shifts from the merchant to the card issuer.

Only customer-initiated transactions can be 3DS-authenticated for liability shift. As a result of the original 3DS authentication, subsequent merchant-initiated transactions (e.g. subscription payments) have significantly reduced fraud risk, but do not have liability shift.

3DS is not mandatory, but it boosts approvals and reduces fraud significantly.

Yes—Face ID, Touch ID, and app-based confirmations are fully supported.

Yes—SeamlessPay provides full SCA coverage and exemption logic.