If your business accepts credit cards, you might be paying too much in credit card processing fees. Reduce your expenses with surcharging from SeamlessPay.

Setting up credit card surcharging with SeamlessPay is quick and easy—no complex contracts or setup fees. Simply sign up for an account and start processing credit cards fee-free.

SeamlessPay’s surcharging solution is compliant with all major credit cards, as well as state and federal regulations. This means you can safely surcharge while giving your customers the flexibility to pay exactly how they want.

With a credit card surcharge, you can pass the processing fees on to your customers. Receive 100% of your sales from each credit card sale.

If you’re ready to start offsetting credit card processing fees, there are just a few simple steps to follow:

To get started, simply log in, or create your SeamlessPay account, and let us know you’re ready to enable surcharges. No developer needed. It’s as easy as flipping on a light switch!

Once surcharging is enabled, you’ll need to notify customers they’re being charged a fee for credit card payments before they make a purchase. This can be done in a number of ways, including adding a notice to your website, menu, invoices, or next to your point of sale.

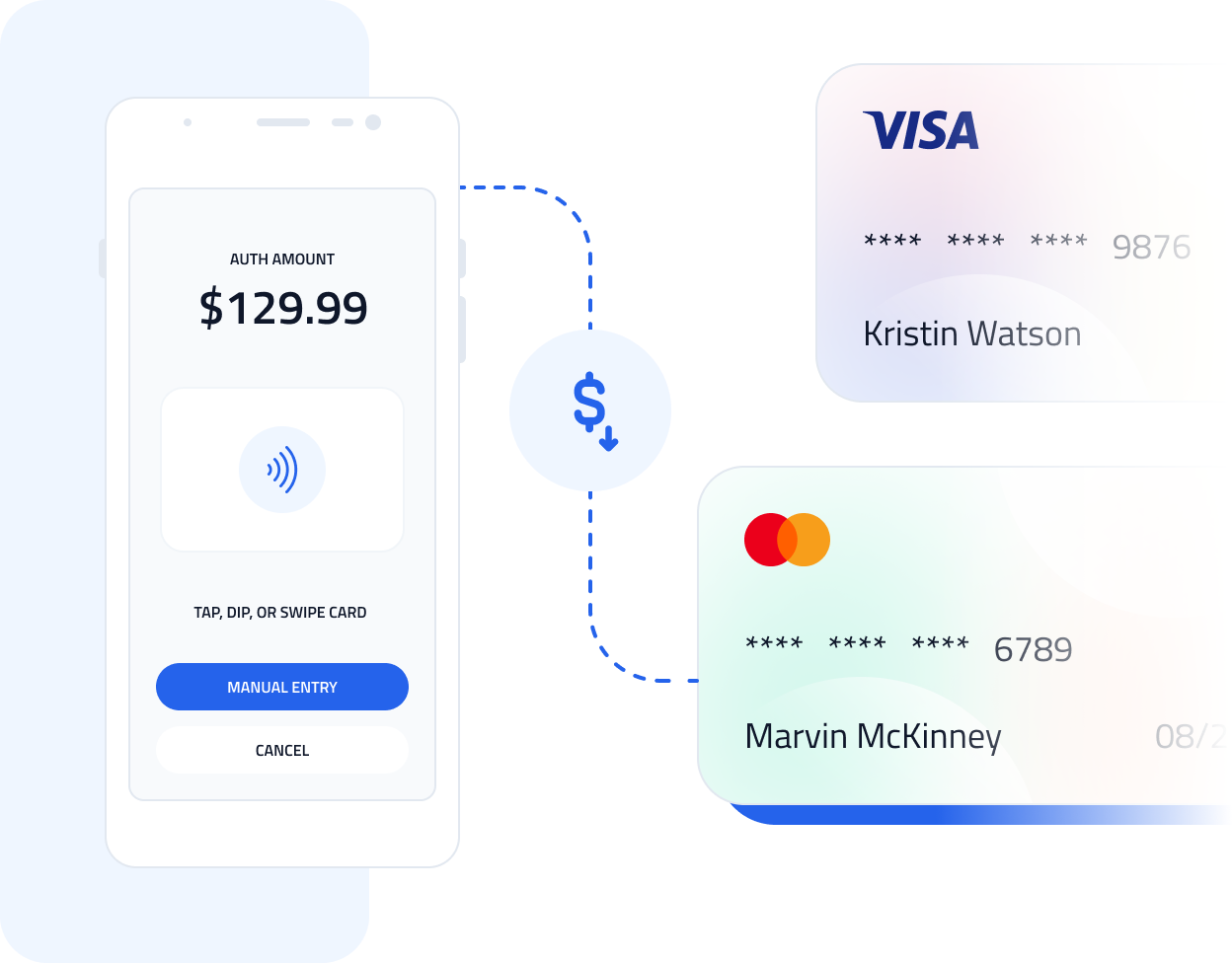

After you’ve enabled surcharging and notified your customers, you’re ready to start accepting credit card payments without paying any fees! SeamlessPay’s simple setup works with most major credit cards.

A surcharge is a fee charged to customers for using a credit card.

A convenience fee is an additional fee levied on alternative payment channels. The fee could apply to customers who pay by phone or use a credit card online.

A cash discount is a reduction in the price of goods or services when paid by cash.

Check out our blog for a more detailed look at these zero-cost processing solutions.

No, credit card surcharging is not illegal in most of the US. However, the surcharge amount is limited to four percent of the total sale amount and cannot exceed the amount it costs to process the payment.

In addition, there are a few states that have restrictions on surcharging and it is illegal to surcharge debit or prepaid card transactions.

In general, most credit card transactions that are processed through SeamlessPay can be surcharged. Exceptions include transactions that occur in states where surcharging is banned or restricted.

Yes, it’s mandatory to let your customers know that they will be charged a fee for credit card payments.