For today's consumers, hassle-free, convenient payment options are more than a perk—they're a requirement. To be competitive in today’s landscape, businesses need to adopt an omnichannel payment processing solution that will provide customers with a frictionless experience across all channels.

What is omnichannel payment processing?

Omnichannel payment processing is the ability to accept payments through multiple channels, including in-person, online, and mobile. This type of payment processing allows businesses to meet their customers' needs and provide a seamless experience, no matter how they choose to pay.

For example, a clothing company has a retail presence, a website, and an app. Often, these payment channels are separated into silos that don't communicate. The customer's online behavior has no impact on their in-store experience.

However, with omnichannel payments, the customer’s information, such as payment methods, is stored as tokens making them accessible across each channel. Customers can make refunds and store their card information for future purchases while you track the lifetime spend of the customer across all channels.

With a solution like SeamlessPay, you’re one step closer to being a fully omnichannel business with features like omnichannel tokens, mobile and e-commerce SDKs, and card-present terminals to operate wherever your customers are.

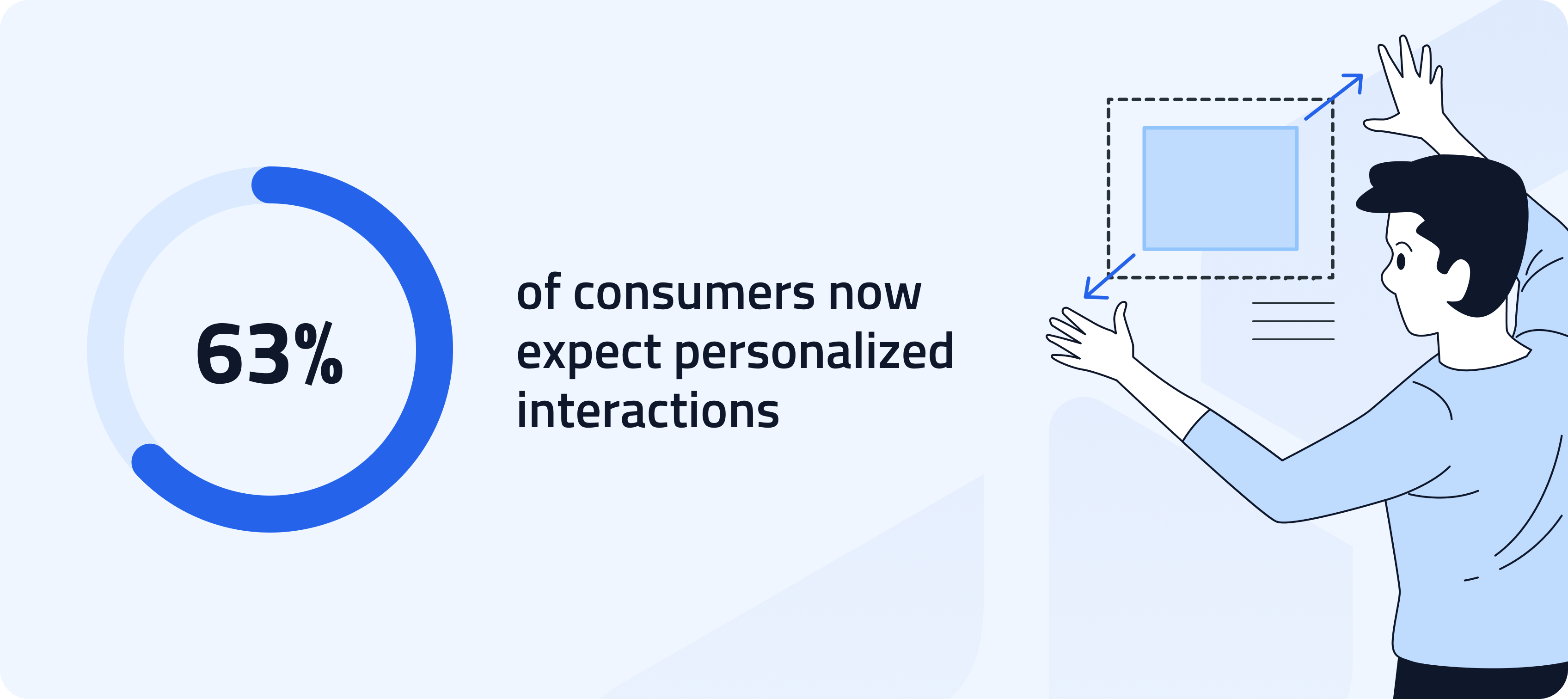

This personalization can have a significant impact on your customer base. Research shows that 63% of consumers now expect personalized interactions.

Multichannel payments give businesses a holistic view of their customers, allowing them to provide a genuinely frictionless experience.

Types of omnichannel payment channels include:

In-person

- point-of-sale (POS) systems

- mobile POS devices

- self-service kiosks

Online

- online checkout

- email invoicing

Mobile

- apps

- text messages (SMS)

Benefits of omnichannel payments for your business

There are many omnichannel benefits, whether you're trying to improve your bottom line or brand reputation.

Simplify reporting

Omnichannel payments make tracking your sales and customers easier because the data is accessible in one spot. You can see which channels and products are performing well and where there might be room for improvement. This data can help you make informed decisions about your business strategy.

Save time & reduce overhead

An omnichannel solution allows you to accept payments in multiple ways without having to set up separate systems for each channel. This efficiency can save you time and money by reducing the complexity that comes with managing multiple payment solutions.

Increase personalization

Omnichannel payments give you a 360-degree view of your customer, so you can see their preferences and purchase history. This information is used to provide more personalization, so you can provide customers with the exact payment experience they desire.

Grow your revenue

Omnichannel payments can help you grow your revenue. First, you can reach more customers and tap into new markets. Second, you can increase your average order value by up 20% and improve customer loyalty and retention. By offering payment options your customers prefer to use, you can win more sales than your competition and even more than you would by only offering a single channel. For example, customers who use four or more channels tend to spend 9% more on average than those who only use one channel.

Getting started with an omnichannel payments process

If you're ready to start accepting omnichannel payments, there are a few things you need to do.

You don't have to accept payments through every channel, but you should choose the ones that make sense for your business. Do you send bill-reminder texts? Make sure you’re including a link to a web-based invoice, so they can pay their balances quickly instead of having to call or sign in and find their balances online.

Next, find a payment processor that offers omnichannel solutions. Not all payment processors are created equal, so it's crucial to find one that fits your business needs. Make sure you look into the payment processor's security features as well.

SeamlessPay: A fully-integrated omnichannel solution

SeamlessPay is a leading provider of fully integrated omnichannel payment solutions. We offer a complete suite of products and services to help streamline your payment processing and grow your business on any major channel. We also offer payment solutions that allow for invoicing, subscription management, online checkout, and more.

In addition, SeamlessPay offers a wide range of security features to protect your data. We are PCI compliant and offer end-to-end encryption, role-based access control, event-based audit logging, fraud prevention, and more.

Finally, our team of experts is here to help you every step of the way. We'll work with you to customize a solution that fits your unique needs.

See what a single, integrated payment solution can do for you and your team.