SeamlessPay is the ultimate solution for SaaS businesses looking to modernize their billing and subscription management. Our platform makes it easy to track payments, automate processes, and keep customers happy.

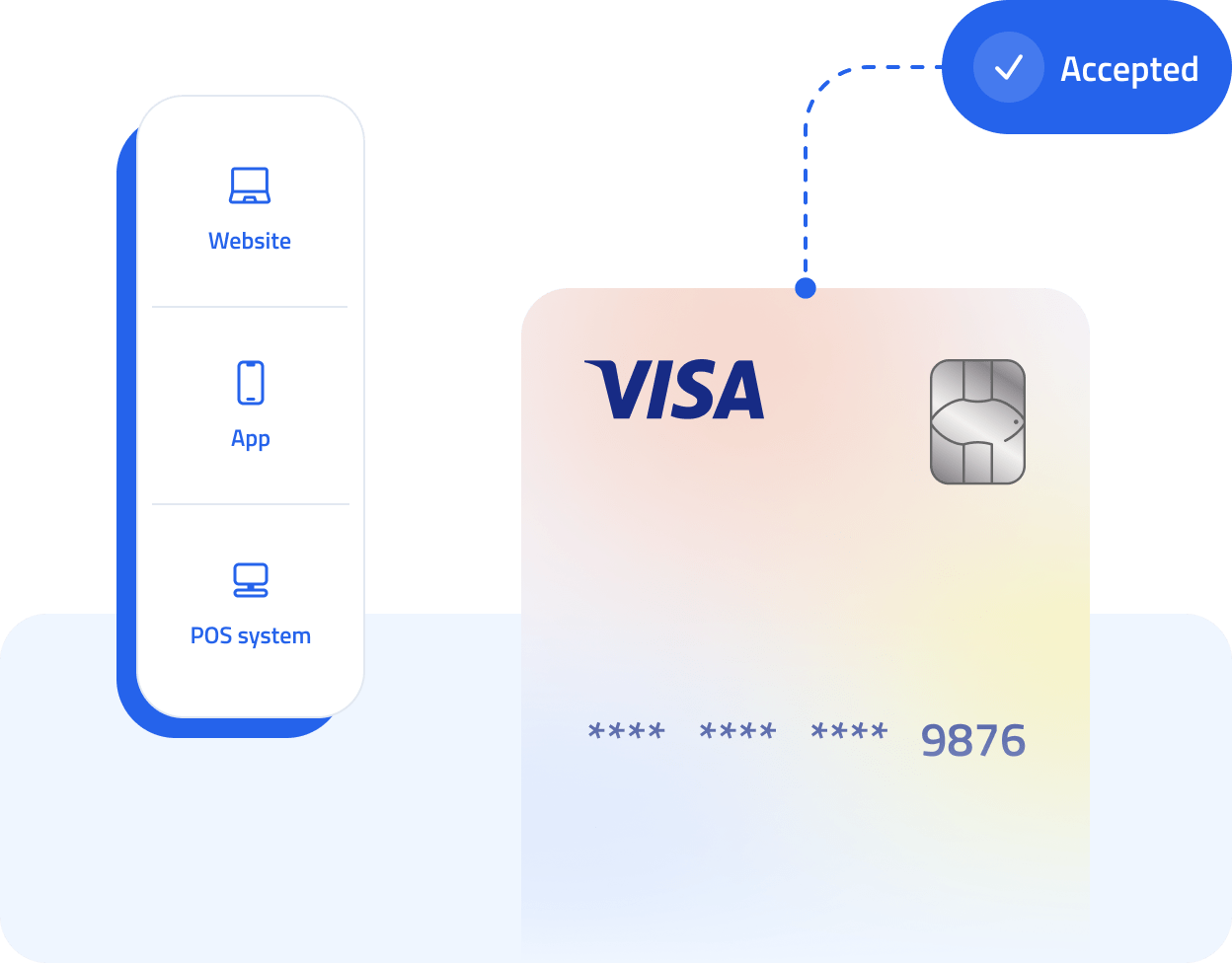

With SeamlessPay, accepting payments is easy and fast. You can connect your existing website, app, or POS system to our secure payment gateway without hiccups. Prebuilt solutions and simple integrations make it easy to get up and running. Signup for SeamlessPay and start accepting payments in minutes.

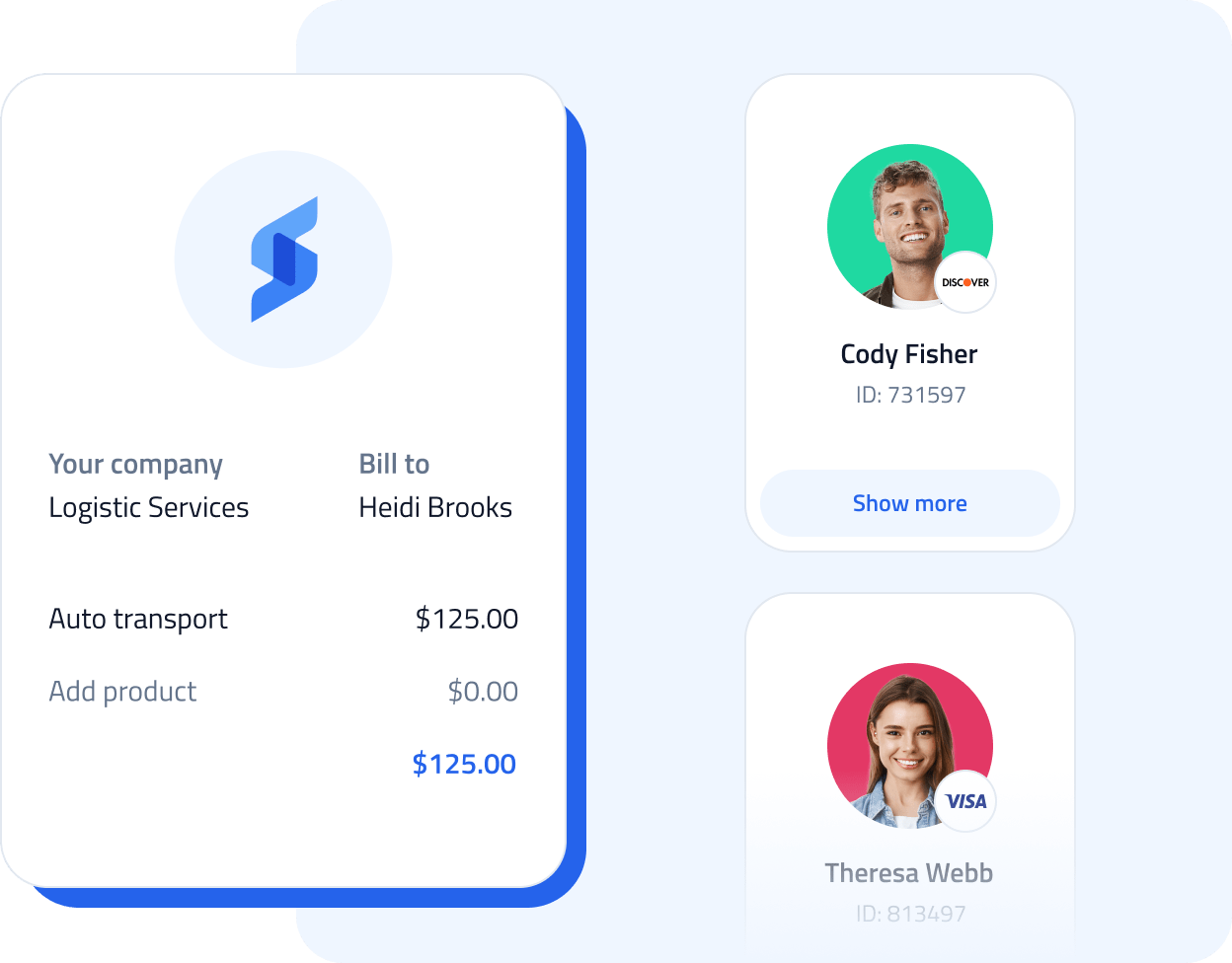

Say goodbye to manual billing processes with SeamlessPay’s automated billing. Our platform makes it easy to collect and store payment information directly from customers so you can focus on managing recurring revenue streams and save time. Plus, our automated card-on-file payment retries help to reduce churn rates, ensuring that you get paid on time, every time.

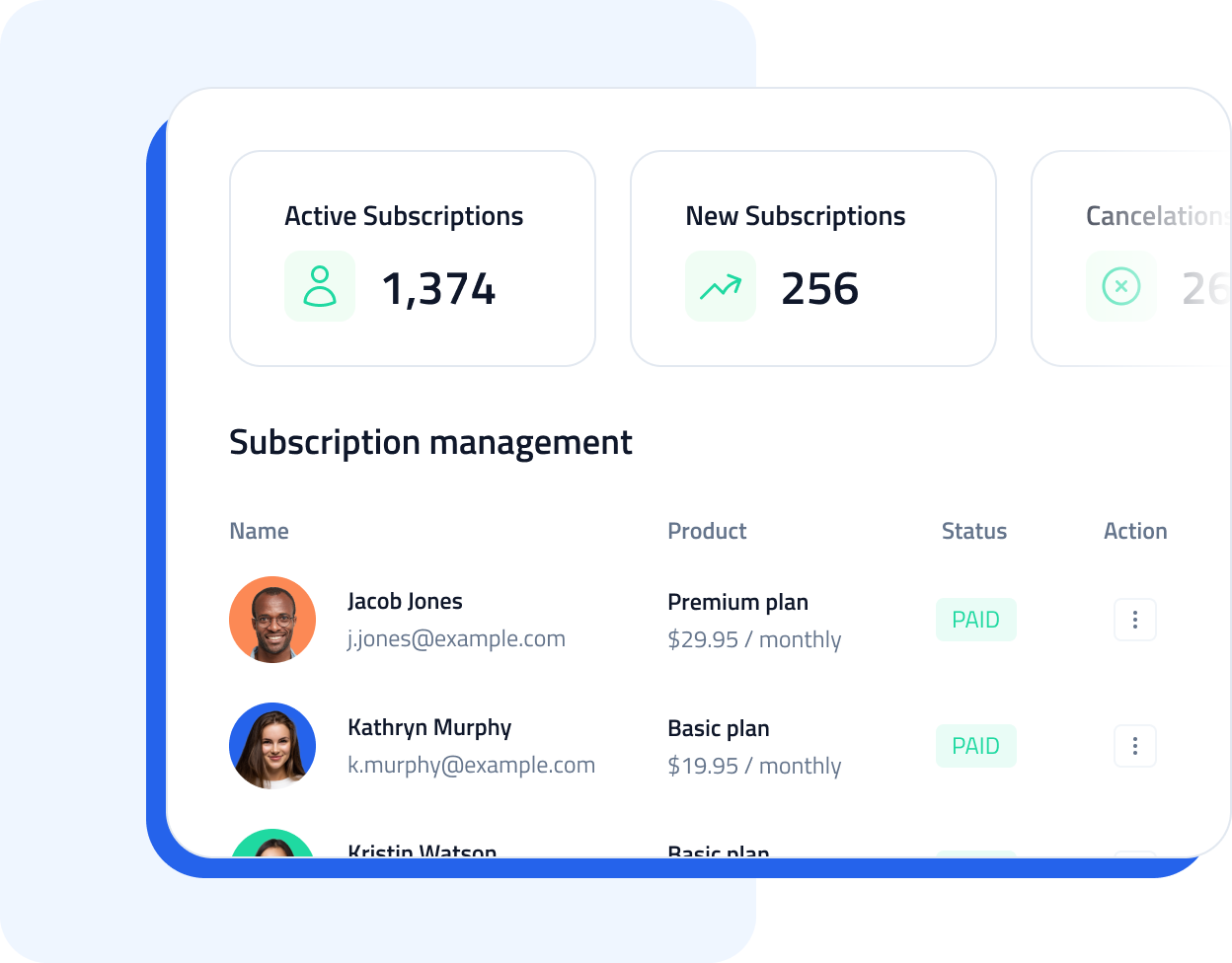

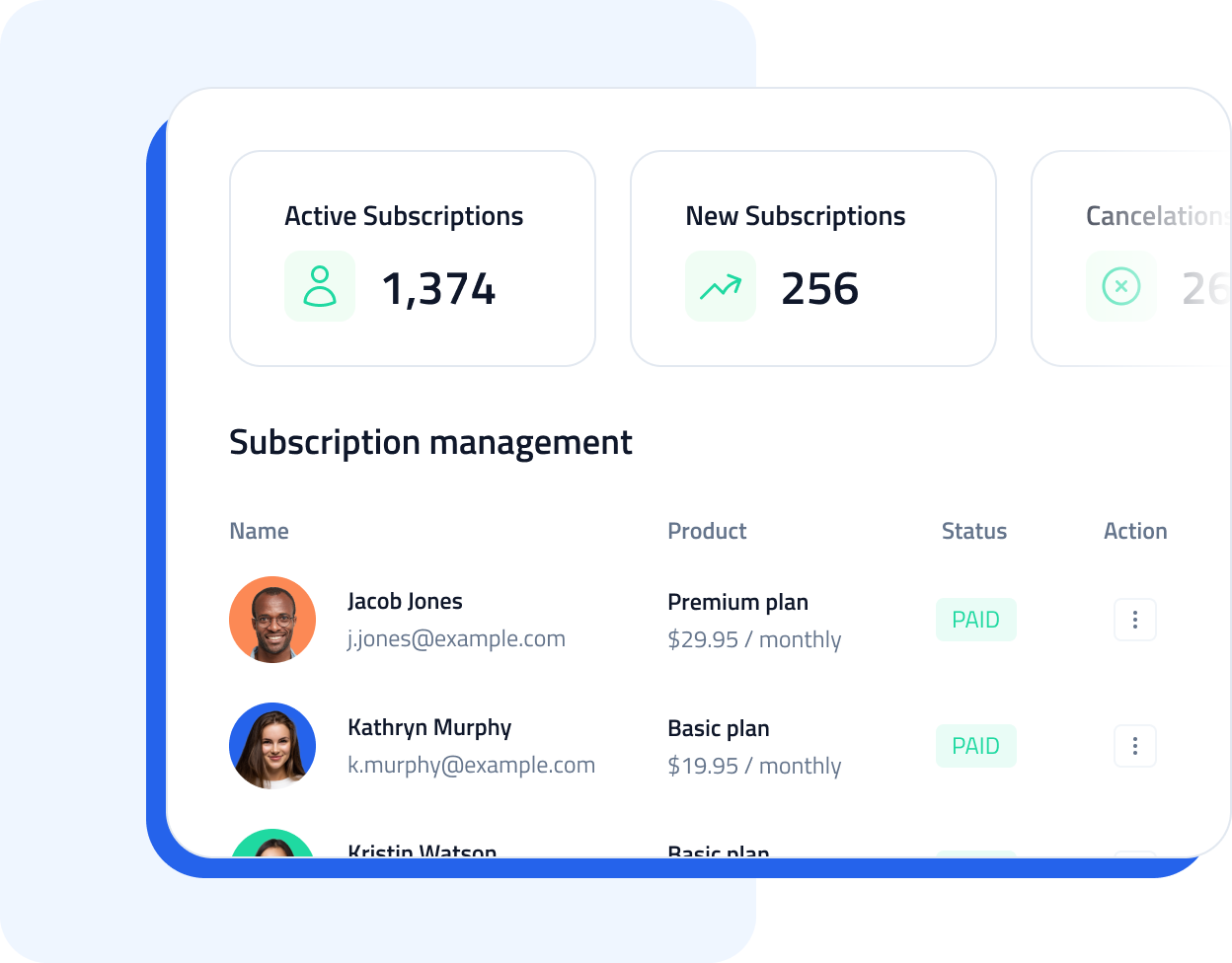

SaaS subscription management shouldn’t require extra work. Seamlessly run your subscription lifecycles with our intuitive subscription management features. With our platform, you can manage subscribers’ details, track their payment history, and easily make changes to their plan all in a single dashboard.

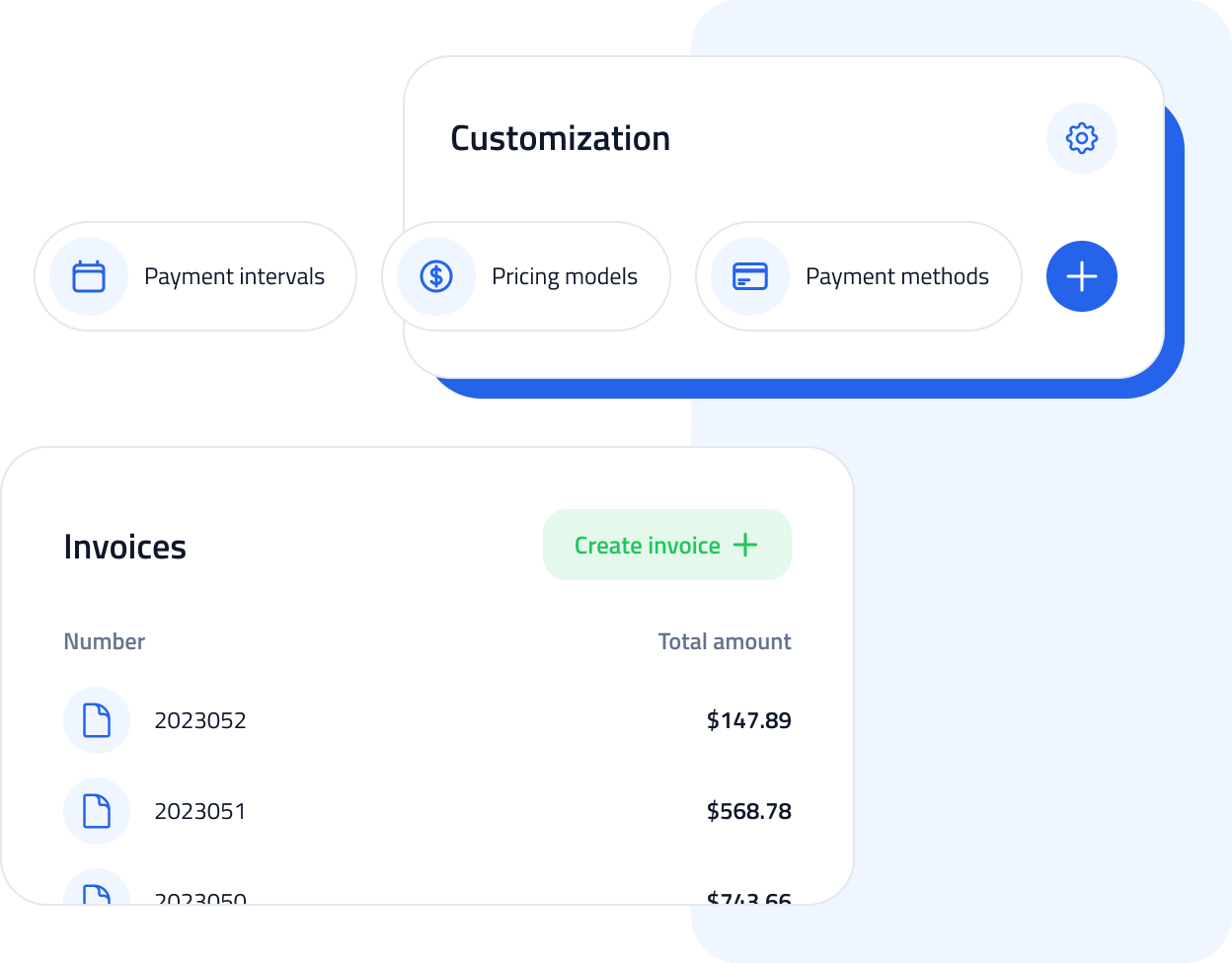

At SeamlessPay, we understand that every business has unique billing needs. That’s why we make it possible to create custom invoices and plans that are fully tailored to your business. Customize everything from payment intervals, pricing models, payment methods, and more to provide a seamless experience for your customers.

A high churn rate throws off your forecasts and strains cash flow. SeamlessPay helps you reduce involuntary churn with secure card-on-file, automated billing, and scheduled payment retries.

With SeamlessPay, you can streamline your payment processes, freeing up engineering and development bandwidth. Quickly and easily add payment capabilities to your existing workflows, without having to start from scratch.

SeamlessPay takes the worry out of SaaS subscriptions. Our advanced fraud detection algorithms and encryption protocols secure your customers’ data.