SeamlessPay helps high-growth businesses increase approvals and survive card network monitoring programs using AI-powered routing, network tokens, 3D Secure and dispute automation.

Most businesses lose 5–15% of revenue to false declines, fraud, chargebacks, and bad routing decisions. Traditional processors optimize for themselves and not for your approval rates, your risk profile, or your growth. SeamlessPay puts intelligence and control on top of your payment stack so every transaction is treated as a decision, not just a request. Without this layer, you’re leaving revenue, data, and control in someone else’s hands.

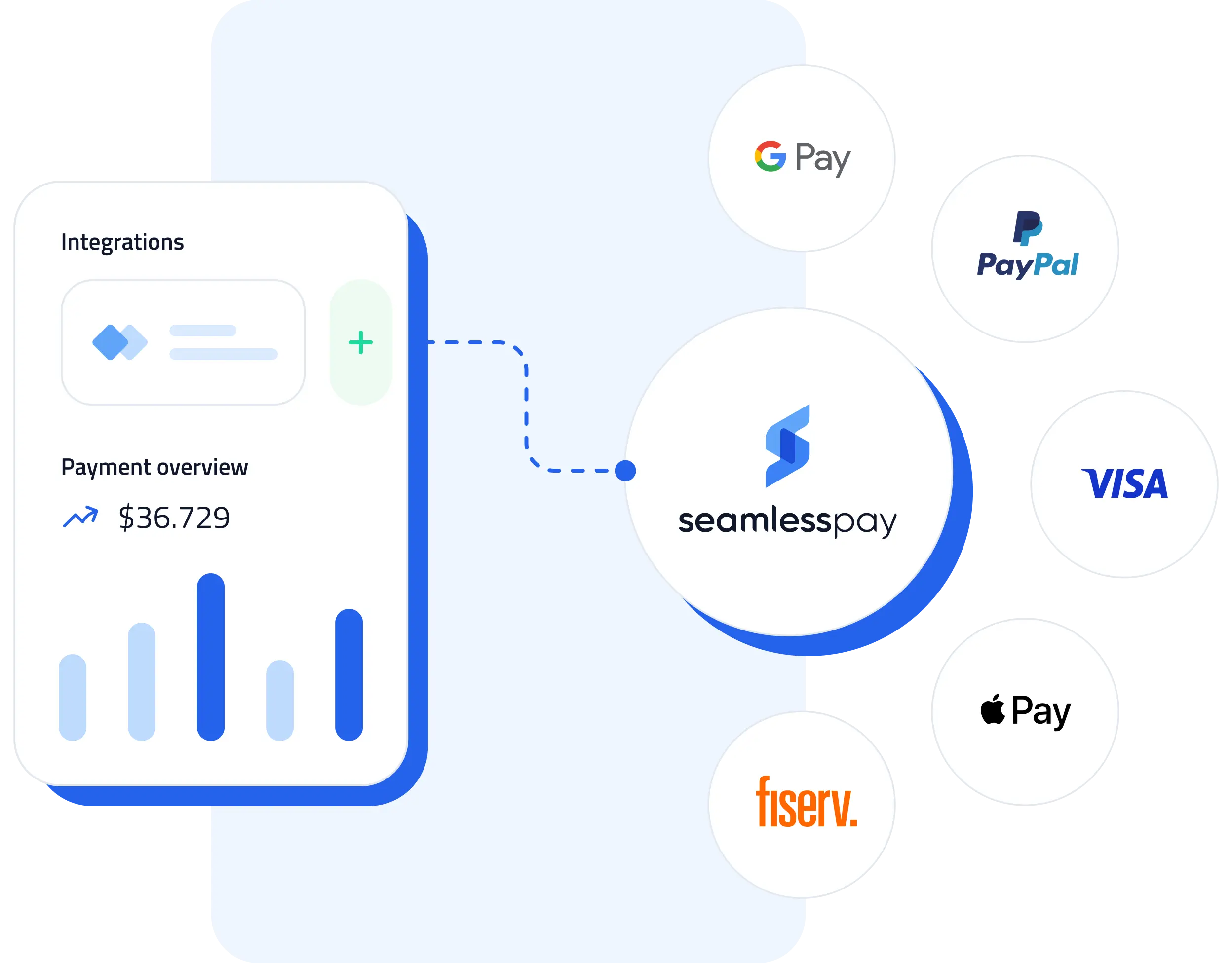

SeamlessPay enables businesses to route payments smarter, increase approvals, and reduce fraud without being locked into a single processor. With one integration, you can orchestrate providers, unify tokens, and run payments globally with total control. Our suite of products include 3D Secure, network tokens, fraud scoring and AI driven dispute re-presentment and chargeback mitigation.

Create the intelligence layer that decides how every payment should be routed, authenticated, and protected in real time.

Most businesses lose revenue to hidden declines, rising fraud, and chargebacks because payment decisions are static and processor-driven.

SeamlessPay sits above processors to make smarter payment decisions that increase approvals, reduce risk, and protect revenue.

We combine routing, tokenization, 3D Secure, fraud scoring, and dispute automation into a single system that optimizes payment performance.

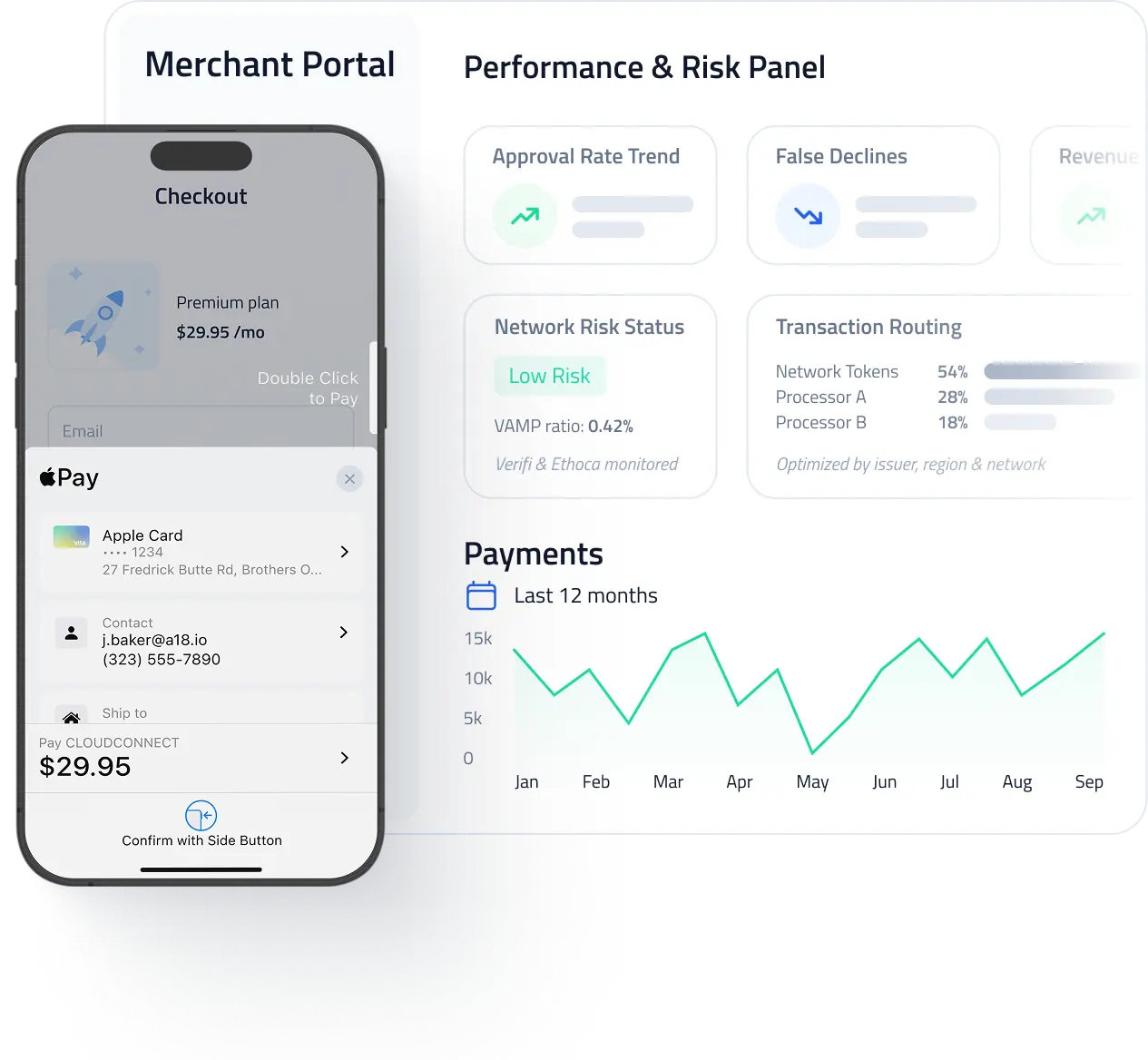

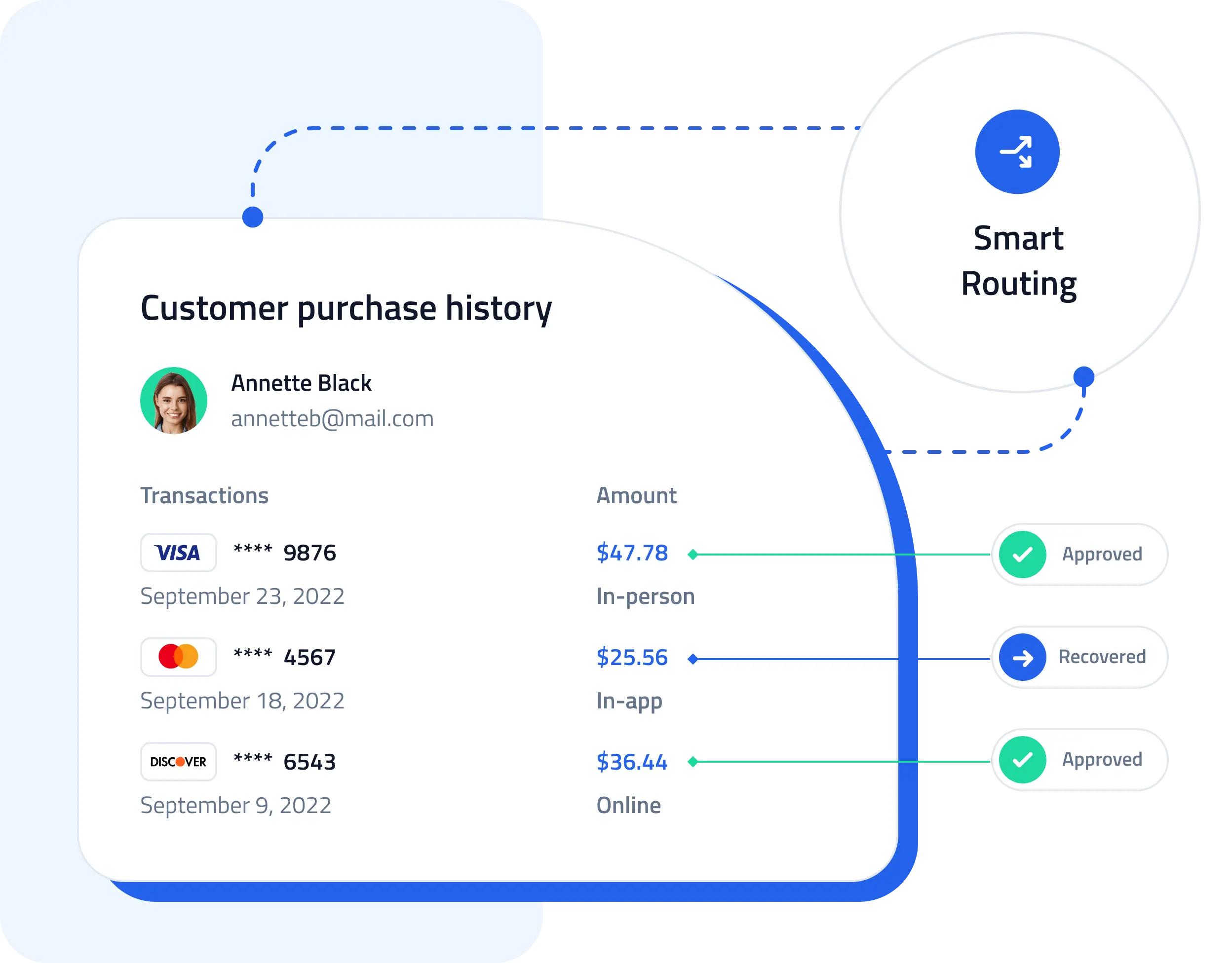

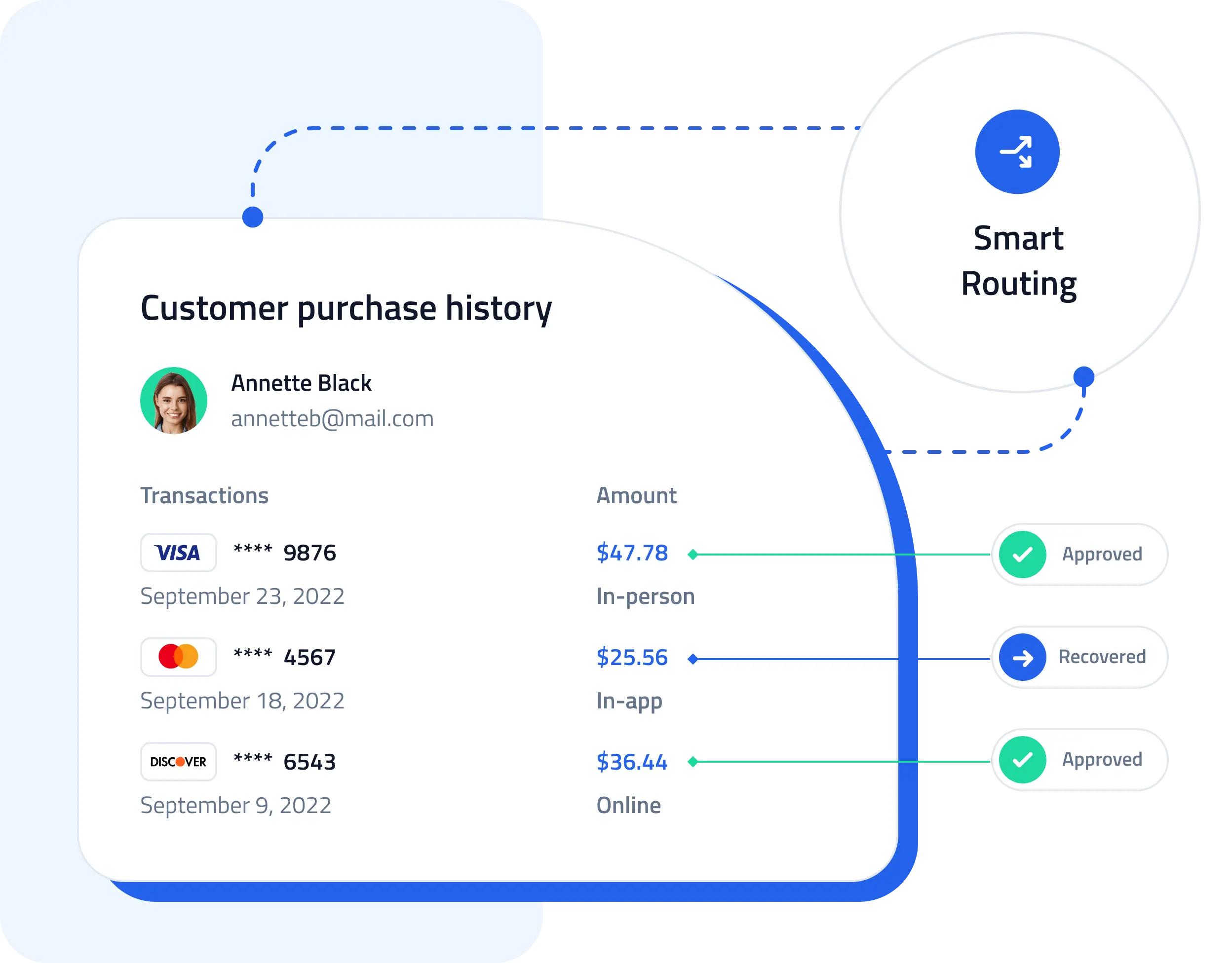

SeamlessPay uses smart routing, network tokens, intelligent retries, and account updater to make sure every transaction is sent down the path with the highest probability of approval. Instead of static processor rules, each payment is optimized in real time to recover revenue lost to false declines and poor routing decisions.

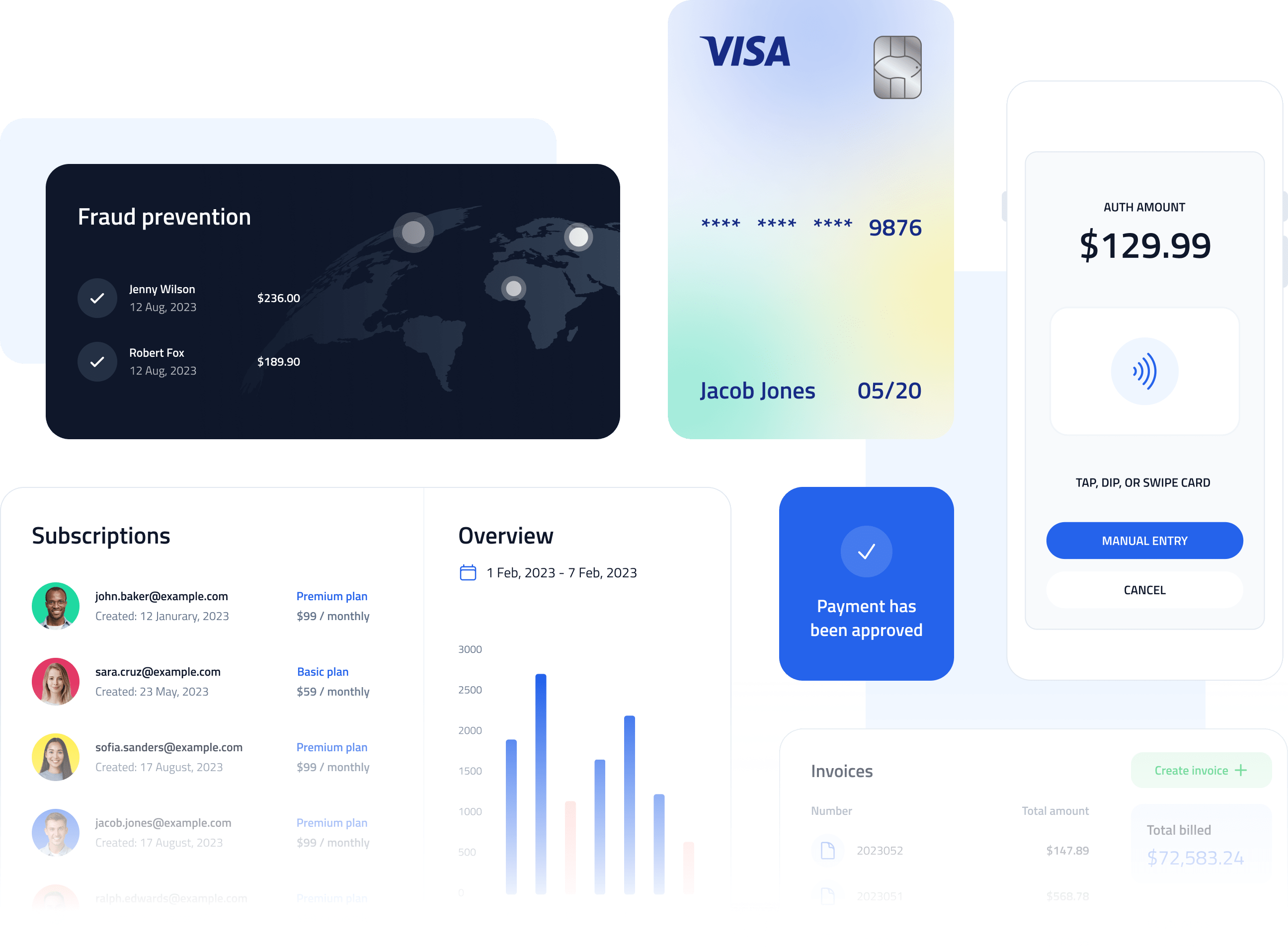

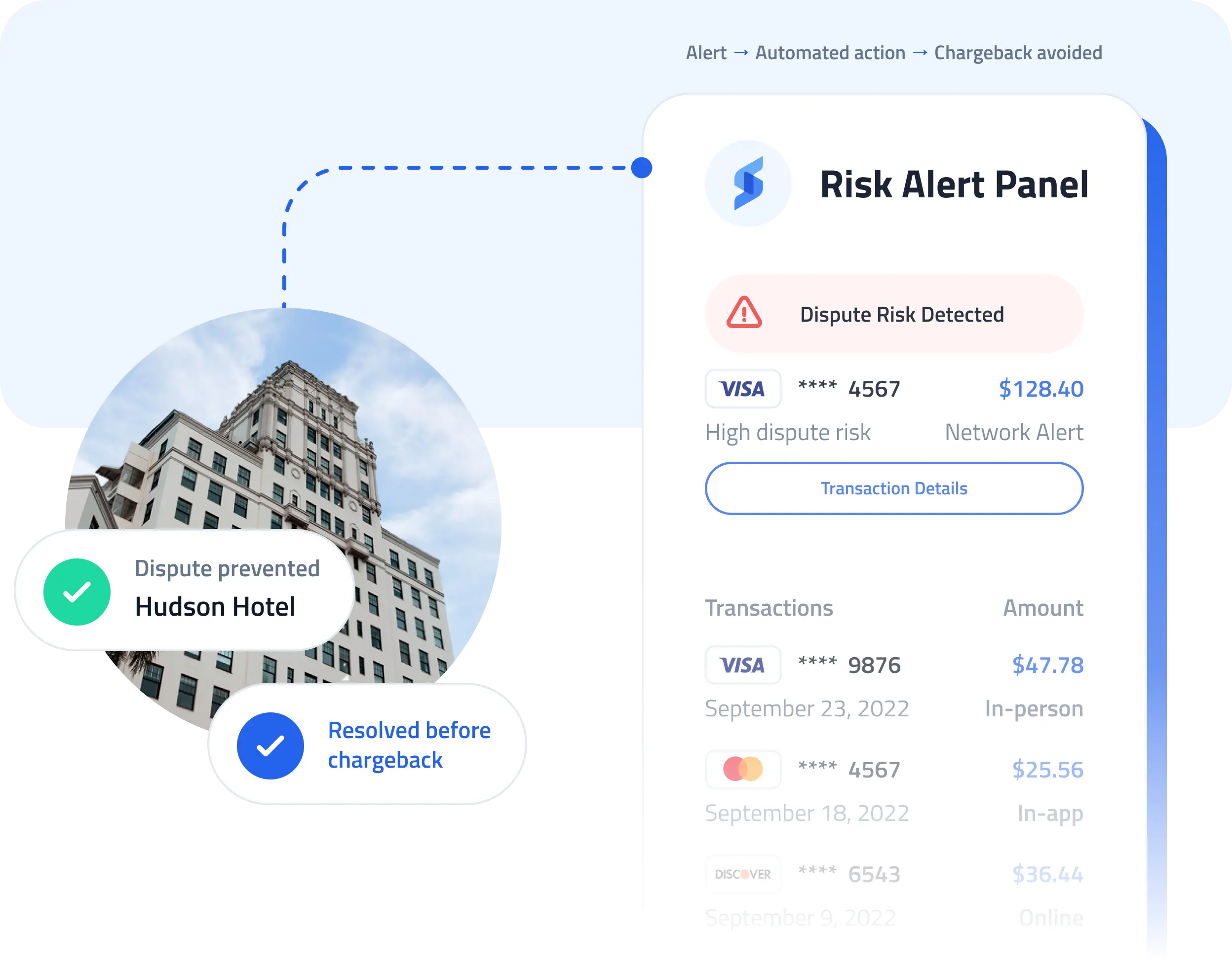

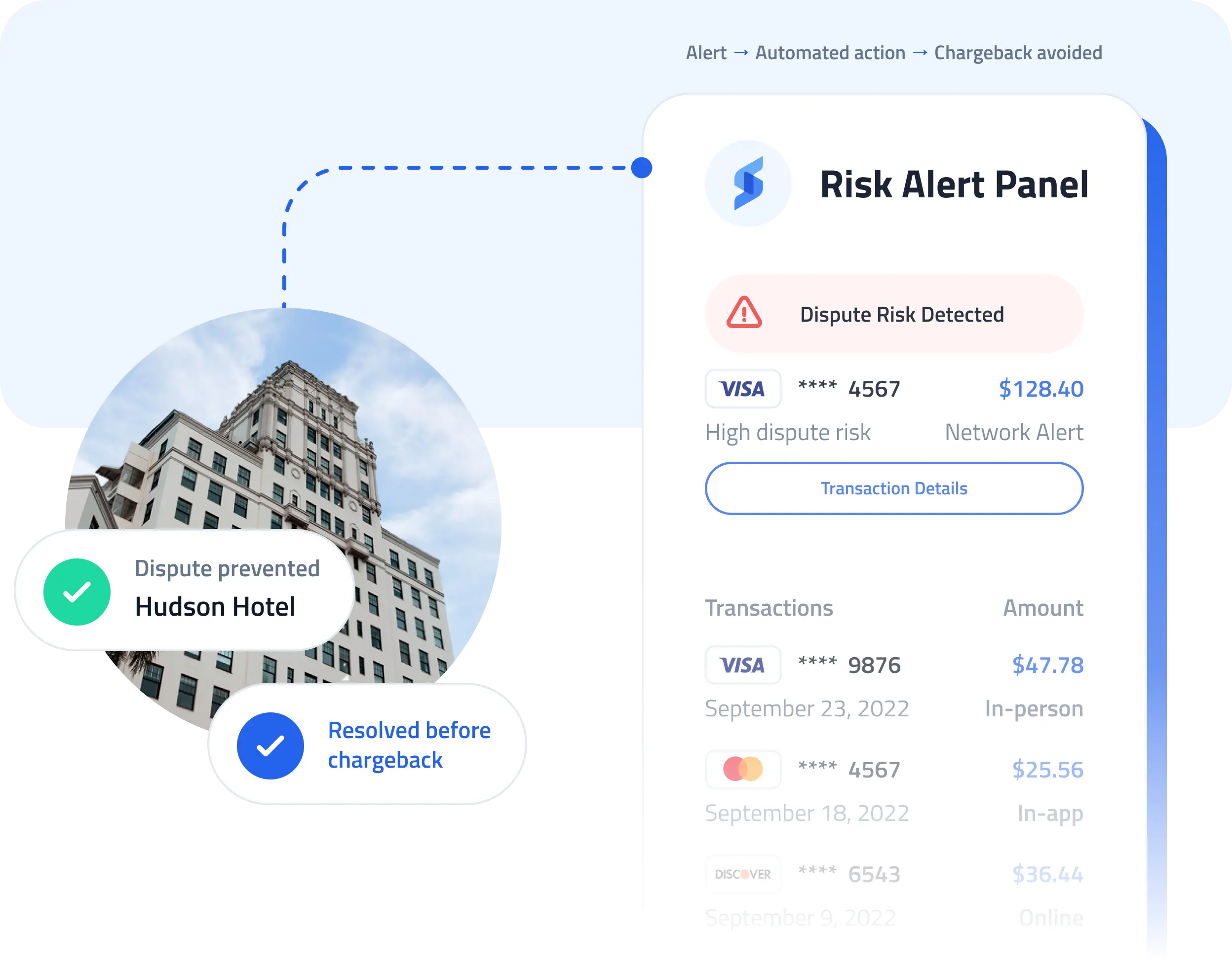

Stop fighting disputes after the damage is done. SeamlessPay combines Verifi and Ethoca alerts with AI-powered dispute automation to resolve issues before they become chargebacks and to maximize win rates when they do. Built-in VAMP monitoring and prevention helps protect your account, your margins, and your ability to keep processing.

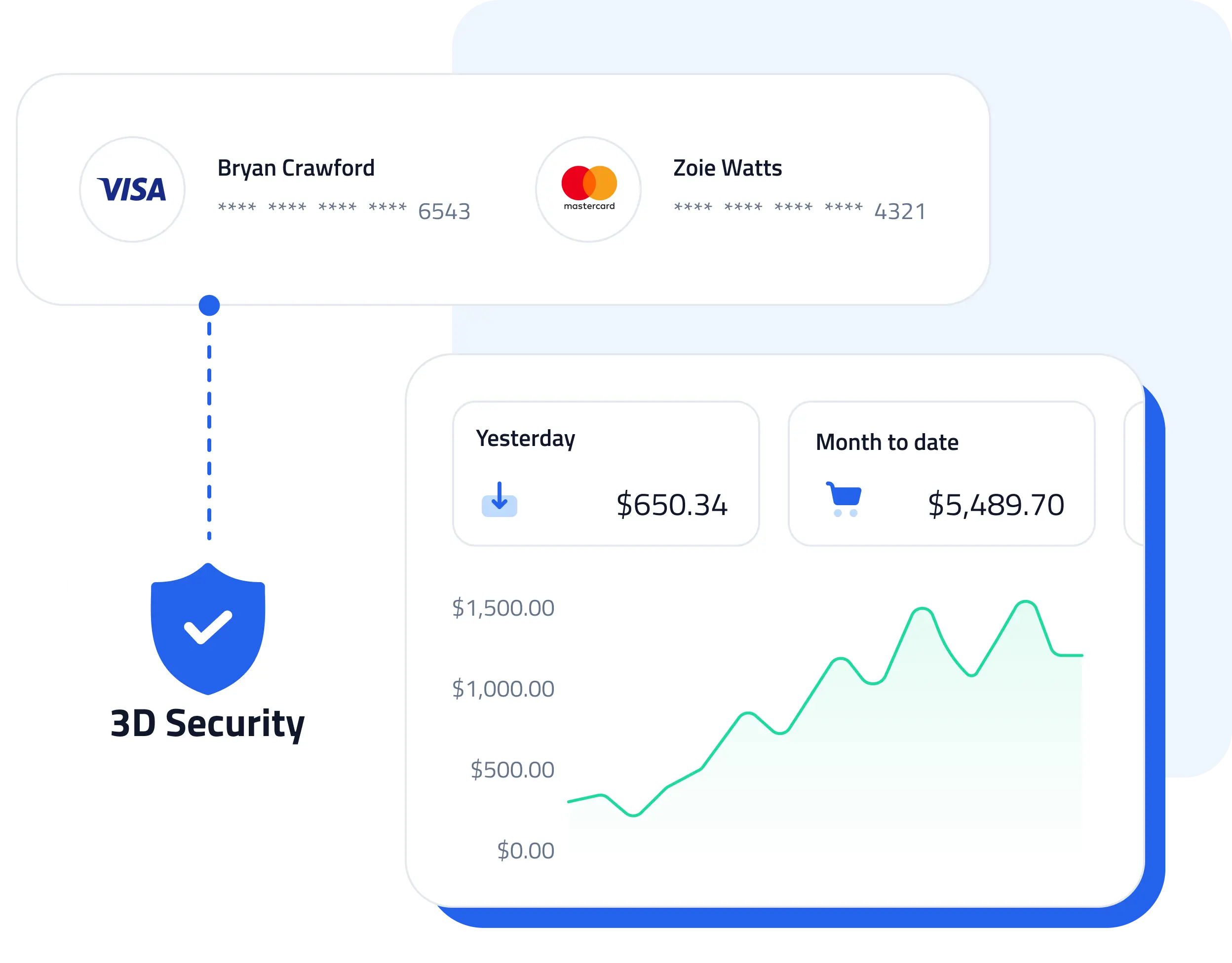

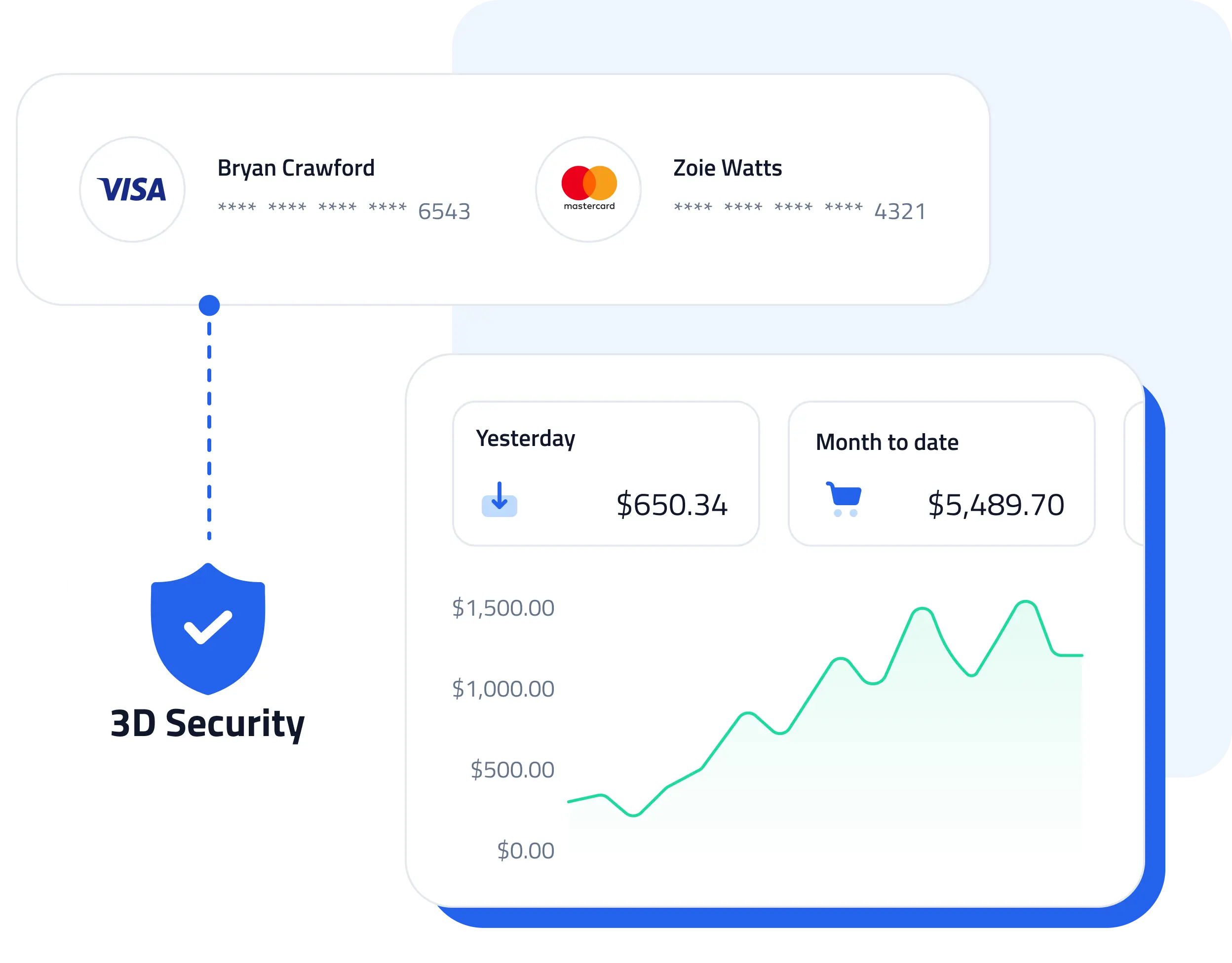

SeamlessPay applies adaptive 3D Secure, real-time fraud scoring, and BIN-level controls to evaluate risk on every transaction as it happens. High-risk traffic is stepped up, blocked, or rerouted automatically so you can stop fraud without sacrificing legitimate approvals.

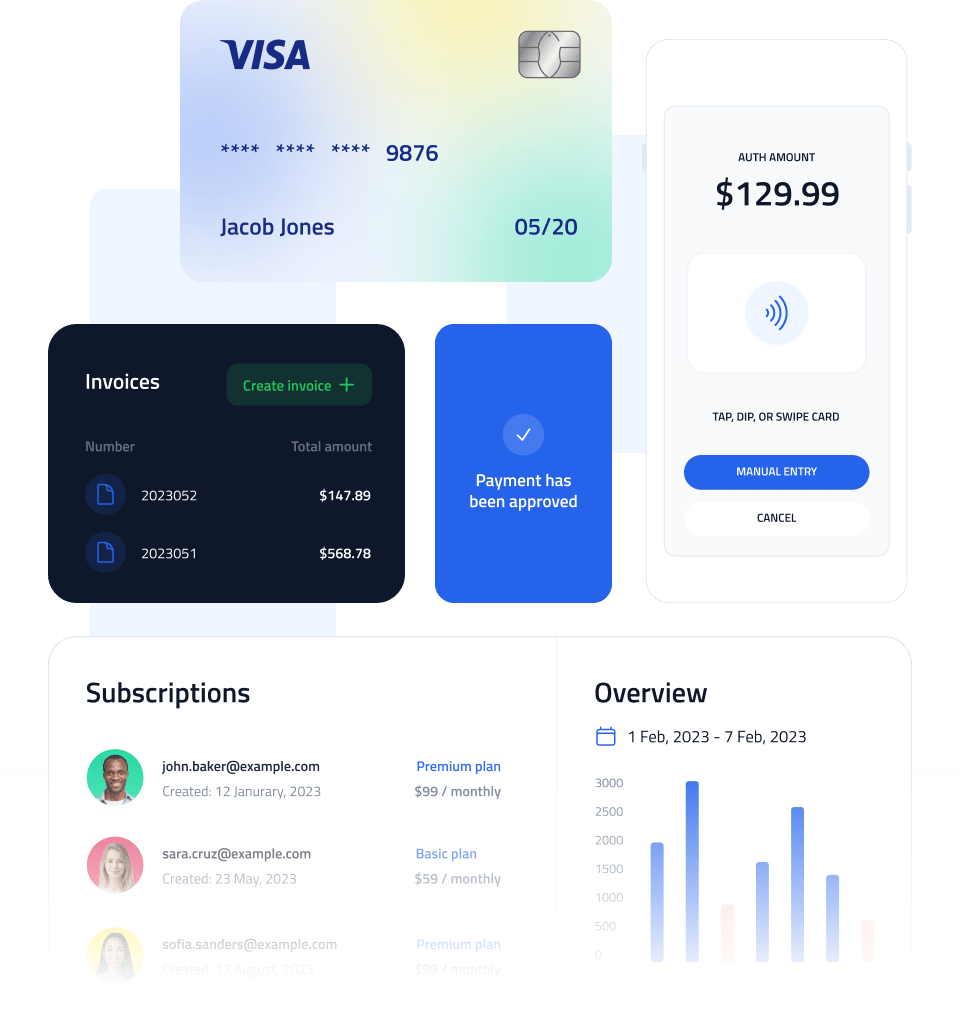

Build on a modern foundation with tokenization, multi-processor support, and portable payment credentials that free you from vendor lock-in. SeamlessPay gives you the flexibility to change providers, expand globally, and evolve your payments strategy without replatforming or rewriting your stack.

SeamlessPay is designed to produce measurable business outcomes, not just move payments from point A to point B. Every decision the platform makes is focused on increasing revenue, reducing risk, and protecting your ability to scale.

Recover revenue lost to false declines, bad routing, expired cards, and overly aggressive fraud rules using smart routing, network tokens, account updater, and intelligent retries.

Stop disputes before they become chargebacks with Verifi and Ethoca, automate evidence with AI, and use adaptive authentication to reduce both fraud and friendly fraud.

Most businesses lose 5–15% of potential revenue in payments. SeamlessPay identifies where money is leaking and systematically recovers it across your entire payment stack.

Protect your business from Visa and Mastercard monitoring programs (including VAMP) with built-in dispute prevention, fraud controls, and real-time risk visibility.

SeamlessPay is built for companies where payments are mission-critical, performance matters, and small improvements have massive financial impact.

Built for:

If you need:

SeamlessPay becomes the decision layer that optimizes and governs your entire payments ecosystem.

Ideal for:

If your business struggles with:

SeamlessPay gives you control, stability, and performance without forcing you into a single provider or fragile setup.

Integrated payments help to automate the accounting processes across your business. With an integrated system, you can accept payments across different channels while managing those payments with one, single platform

An application programming interface (API) allows two pieces of software to communicate with each other. A payment API lets you process and manage payments through your website or app

With SeamlessPay, you can accept payments in any channel, including:

SeamlessPay reduces compliance burden by handling PCI Level 1 sensitive data, enabling secure tokenization, and supporting modern authentication standards like 3D Secure. This helps businesses meet security requirements while focusing on growth—not regulation

SeamlessPay improves approval rates by enabling network tokens, 3D Secure authentication, and real-time risk analysis. These tools work together to reduce false declines while maintaining strong fraud protection

SeamlessPay supports B2B, SaaS, professional services, marketplaces, and online businesses that need secure, scalable payment infrastructure. Our platform is designed for companies with complex payment flows, high transaction volumes, or elevated fraud risk